Sustainable Growth of Local Businesses

We will contribute to the sustainable growth of local companies by working together as a group to provide high value-added solutions that deeply engage the management strategies of our customers by sincerely addressing the issues they face.

Medium-Term Management Plan Strategy(Medium-term Management Plan for FY2022 to FY2024)

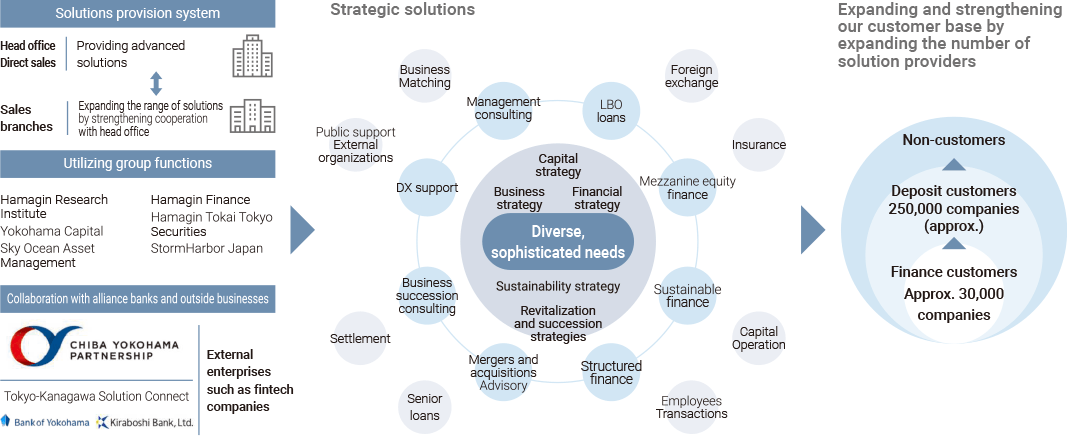

Provide solutions utilizing group and alliance functions etc.

We aim to be the first choice as a partner for our clients by utilizing group functions and deepening cooperation with outside businesses, by strengthening the provision of strategic solutions that deeply engage management strategies for business, finance, and capital, and by responding to increasingly diverse and sophisticated needs.

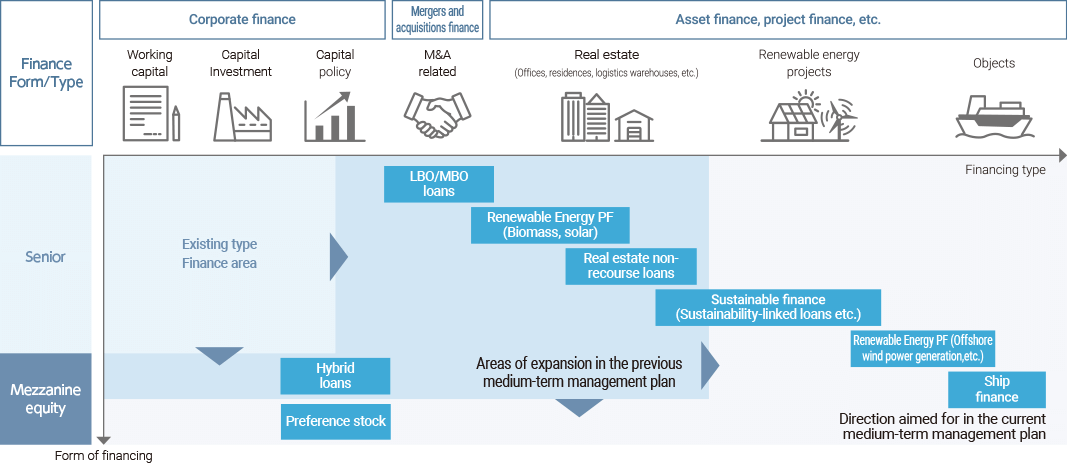

Deepening and expanding from traditional finance areas

We will improve profitability by strengthening asset allocation in financing ar eas that go beyond conventional frameworks, such as M&A financing, and by working to provide high value-added financing.

We will further expand the finance areas broadened in the previous medium-term management plan, and str engthen our sourcing capabilities by leveraging the know-how accumulated at head office in areas such as M&A finance and project finance, returning it to and sharing it with our sales branches. This will help increase our balance of structured finance. To enhance our presence in the home market, we will build up se nior loans and strengthen the allocation to high-profit assets, aiming to improve our profitability.

We will increase senior loans to strengthen our presence in the home market and allocate more to highly profitable assets, thereby enhancing our earning power.

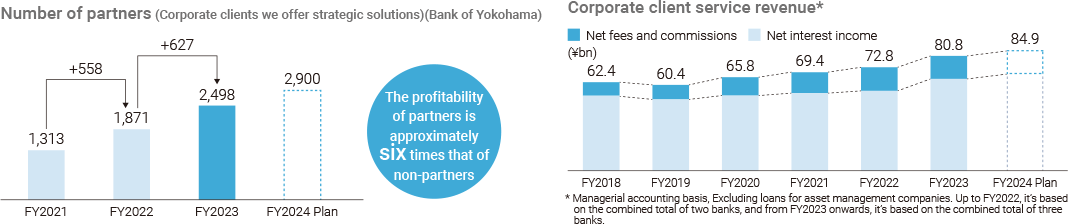

Strengthen profitability through the provision of strategic solutions

In the current medium-term management plan, we have positioned solutions that deeply engage in management strategies as “strategic solutions”, and we define customers who select strategic solutions as “partners”. We are expanding and strengthening our customer base in the home market by offering solutions not only to loan customers, but also to local companies, including deposit customers and companies that are not yet customers. The profitability per partner company is high, and we are working to improve our profitability through initiatives that customers can choose. Corporate division revenue is steadily increasing with the enhanced provision of high value-added strategic solutions.

Corporate client service revenue has steadily increased as we strengthened our provision of high-value strategic solutions.

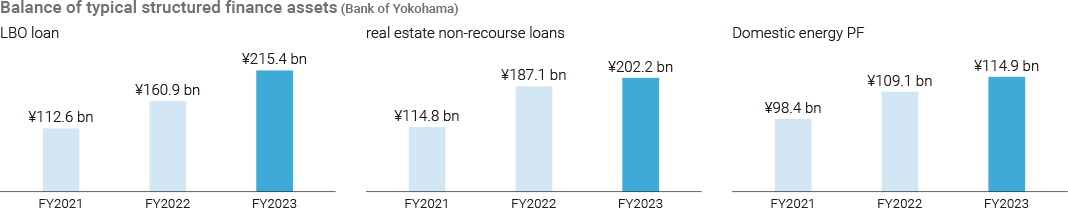

Strengthening efforts in areas of finance beyond conventional frameworks

During the previous medium-term management plan, we expanded our efforts from traditional lending centered on senior loans to new areas of finance such as M&A finance.

Under the medium-term management plan, we will further expand finance areas and strengthen our sourcing capabilities by taking the know-how accumulated at headquarters in areas such as M&A finance and project finance and returning it to our sales branches and sharing it with them, thereby increasing our structured finance balance.

We will enhance our earning power by strengthening our allocation to highly profitable assets.

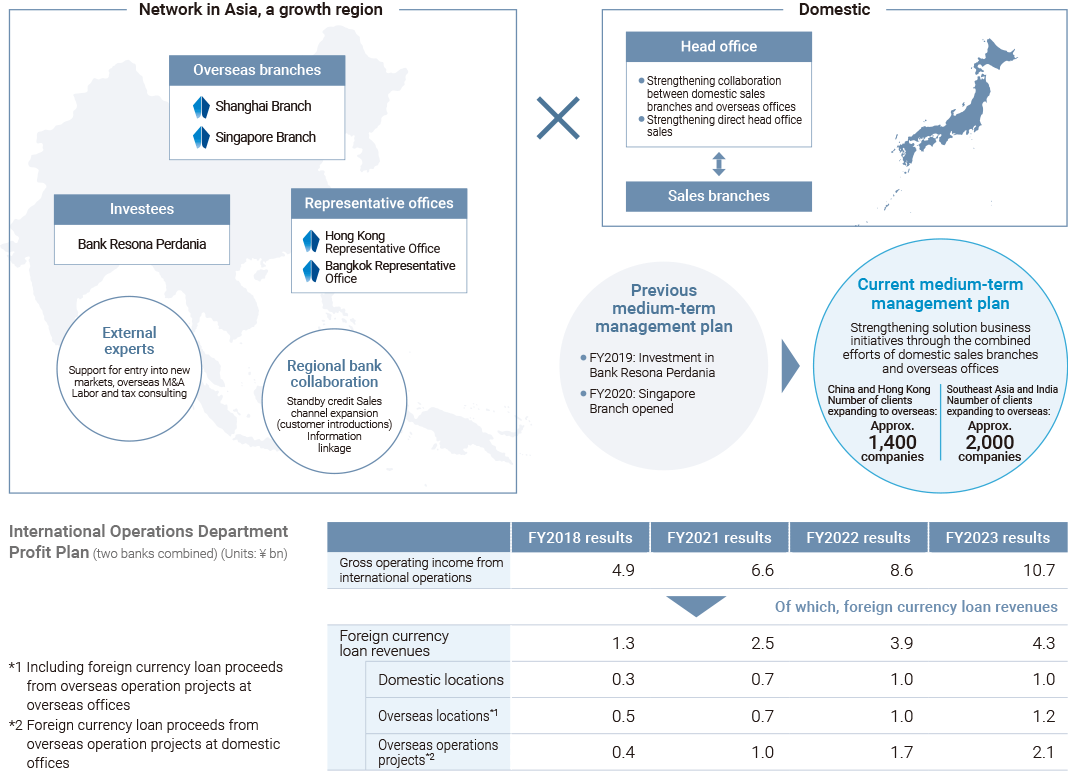

Strengthen solution business by utilizing overseas bases

With a focus on Asia, which is a growth region, our domestic sales branches and overseas offices will work together to strengthen the provision of solutions to our customers.

Specifically, in addition to strengthening financial support such as loans to overseas subsidiaries of our customers, we will provide solutions such as overseas expansion support and M&A in cooperation with external experts and other regional banks. In addition, we will enhance profitability by strengthening our efforts in overseas operations, including loans to non-Japanese corporations.

Initiatives

① Increase in lending to customers’ overseas subsidiaries

- Overseas branch loans

- Cross-border loans

- Standby credit

② Borderless development of solution business

- Expansion support

- M&A

- Sales channel expansion

③ Strengthening initiatives for overseas operations

- Portfolio Diversification (Country/Industry)

- Strengthening sourcing capabilities (use ofoverseas offices)

- Expansion of initiative target areas (non-Japanese high credit areas)

Higashi-Nippon Bank’s Initiatives (Strategy to Be a Total Partner for Small and Medium-sized Enterprises)

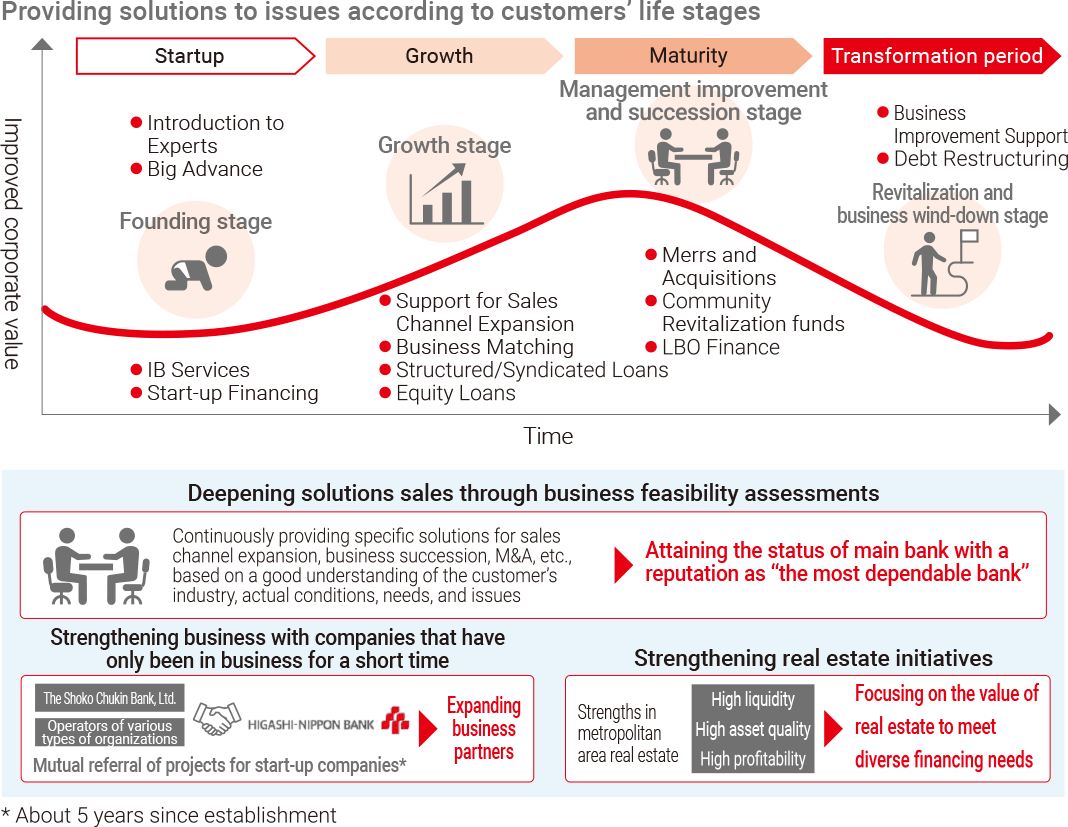

Aiming to be a “total partner for small and medium-sized enterprises,” we will provide optimal solutions for each customer’s lifecycle by providing sympathetic “face to face” service.

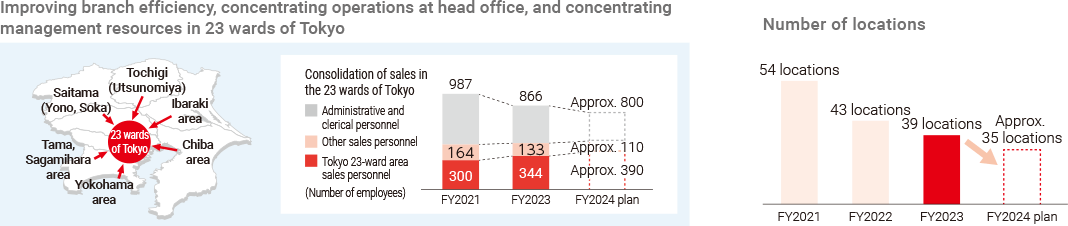

In addition, by increasing branch efficiency, consolidating operations at headquarters, and concentrating management resources in the 23 wards of Tokyo, we will achieve an operating structure that achieves overwhelming efficiency as a regional bank in the 23 wards of Tokyo.

Strengthening support f or each stage of corporate life

Through business feasibility assessments, we will better understand the needs and issues of our cust omers and enhance our solution offerings for all lifecycle issues, thereby contributing to the sustainable enhancement of their corpor ate value.

Establishment of an efficient sales structure

We will establish an efficient sales structure in the 23 wards of Tokyo by increasing the number of sales personnel in this area and centralizing the administrative work of sales branches into head office.

THE KANAGAWA BANK’s Initiatives

Expected effects of business integration

Strengthening the solution business at THE KANAGAWA BANK

Sharing in Bank of Yokohama’s knowledge and expertise and providing Group functions to further resolve customer issues

THE KANAGAWA BANK is benefiting from the shared insights and expertise of the Bank of Yokohama in sustainable finance and other areas, which help its customers solve their problems. By fully drawing from the Group’s capabilities, we will strengthen our solution business to meet the diversifying needs of our customers.

Key measure

- Accelerating the exchange of human resources between the two banks

- Jointly holding job class/assignment-based training programs

Expansion of transaction base as a regional financial institution

Expanding opportunities to serve customers in the prefecture

Efficient sales activities for the customer segments in which each company has strengths

The Bank of Yokohama has strengths in providing high value-added solutions that are deeply engaged with management strategies for relatively large companies, while THE KANAGAWA BANK has strengths in providing consulting services to small and medium-sized companies to support their core businesses, startups, and second foundings. In addition to expanding the customer base in Kanagawa Prefecture by bringing the two banks, which have few competitive relationships and complement each other, into the same group, the two banks will strengthen face-to-face sales in areas where each bank has strengths, and THE KANAGAWA BANK use of the Bank of Yokohama’s digital channel functions to expand customer contact points will be promoted.

Key measure

- Co-hosting seminars for corporate and individual clients

- Deepening of solution sales through collaboration with the Bank of Yokohama’s affiliated companies

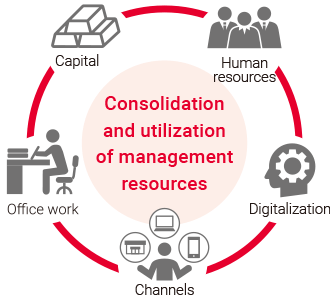

Strengthening the management foundation through improved management efficiency

Improving operational efficiency and creating human resources through DX

We will improve management efficiency by consolidating capital, human resources digital tools, and other management resources and reducing costs through effective utilization of functions, thereby further strengthening the management foundation of the group as a whole.

Key measure

- Introduced the Guarantee Association Loan Web Application Service in collaboration with the Bank of Yokohama and the Higashi-Nippon Bank

Specific examples of strategic solutions provided by the Bank of Yokohama

Capital strategy solutions for listed companies

Since the previous medium-term management plan, we have been increasing the sophistication of our solution business and strengthening our ability to provide solutions for our customers’ capital strategies, centered on professional human resources belonging to our head office direct sales division. Under the current medium-term management plan, we are strengthening our sourcing capabilities by returning the expertise accumulated at head office to the sales branches, and further promoting the provision of capital strategy solutions.

By FY2023, the number of company clients listed on the stock exchange to whom we had proposed solutions climbed to about 500. As our know-how broadens, more and more needs are becoming apparent thanks to the information provided by our sales branches.

For example, we also provide strategic financial and capital solutions through hybrid loans(*1)to listed companies that face the dual challenges of raising funds to implement growth strategies and improving their financial soundness through capital reinforcement.

In FY2023, in our customersʼ funding aimed to foster growth investment, strengthen financial health, and maintain or enhance capital efficiency, we gauged their needs in an early stage and provided timely information through day-to-day interactions with customers at our sales branches. This enabled us to facilitate the execution of two hybrid loans arranged by the Bank of Yokohama. The balance of hybrid loans increased by ¥10 billion from the previous fiscal year, surpassing ¥160 billion.

- *1A loan that is closer to equity than a regular senior loan and has a stronger capital nature A certain percentage is recognized as equity, depending on the rating agency’s assessment.

Turnaround and succession strategy solutions for SMEs

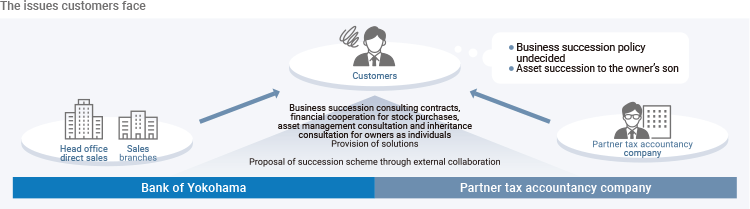

Against the backdrop of the aging of business owners and the absence of successors, which is the case for more than 60% of all business owners(*2), we are actively engaged in supporting business succession in order to support the sustainable growth of local companies. We not only have loan clients, but also a wide range of deposit-only clients, including debt-free companies.

In FY2023, for example, we worked with a customer that had not yet decided on a succession policy to help them decide between various options for business succession, including family succession, internal non-family succession, and M&A. We then supported them in transferring company shares using a holding company by collaborating with a partner tax accounting firm. We set up a holding company with the owner’s son as the principal shareholder. This holding company then acquired all shares of the company, completing the transfer of ownership to the next generation. This created a structure that enabled a focus on selecting a business successor.

This has led to business succession consulting contracts, financial cooperation for stock purchases, and solution proposals such as asset management consultation and inheritance consultation for owners as individuals.

- *2From the Small and Medium Enterprise A gency Business Succession Guidelines (March 2022)

Specific examples of the Bank of Yokohama’s efforts to strengthen its overseas solution business

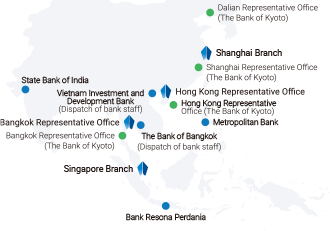

Expansion of support system in Asia

In addition to the Bank of Yokohama’s overseas offices, we are expanding our system to support our customers’ overseas business through collaboration with other organizations and financial institutions.

In November 2021, we signed a business alliance agreement with Kyoto Bank regarding international operations. Since 2015, the two companies have been collaborating at the Bank of Yokohama’s Shanghai branch. This business alliance agreement expands the scope of collaboration from China to ASEAN. By sharing and utilizing the networks and know-how of the two banks and providing higher quality consulting services, we will strengthen our support for our clients’ overseas business.

From November to December 2023 and from February to March 2024, we held the YOKOHAMA FOOD FAIR in Hong Kong, in partnership with Tokyu Malls Development (Hong Kong) Limited. In March 2024, we also hosted the India Business Seminar & Networking Event in collaboration with ICICI Bank in India.

Increase in lending to overseas subsidiaries of our customers

We are enhancing lending to our customers’ overseas subsidiaries through overseas branch loans, cross-border loans, and stand-by credit. Through efforts such as strengthening cooperation between head office, domestic sales branches, and overseas offices, as well as expanding our overseas network, the foreign currency loan balance increased by more than ¥100 billion to over ¥690 billion during the previous fiscal year. In addition, the Singapore Branch is making use of the concentration of shipping companies and strong demand for funds in the Singapore market and is developing loans to Vietnam, Thailand, and other neighboring countries, such as promoting ship finance for local Japanese-affiliated companies.

Borderless development of solution business

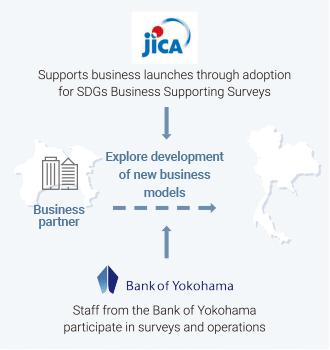

With more than 3,000 business partners expanding into the growing region of Asia, the need for overseas business solutions, such as M&A, new business entry, and local business expansion, is increasing. The Bank of Yokohama is strengthening the borderless development of its solution business by integrating its domestic sales branches and overseas offices.

For example, in FY2023, the Bank of Yokohama supported clients that were exploring new business model expansion overseas in their applications for the SDGs Business Supporting Surveys of Japan International Cooperation Agency (JICA) by providing examination and research support so that the project would be adopted. In the course of carrying out this project, employees of the Bank of Yokohama were praised for their work in surveys and operations.

Specific examples of strategic solutions provided by Higashi-Nippon Bank

Support for start-up and growth companies

For companies that have been relatively recently established, such as those in the start-up or growth stage, we work to provide business matching support with experts and outside businesses in order to support the continued growth of their businesses. For example, in FY2023, we supported a growthstage customer in the unmanned lodging business. As well as financial backing, we offered solutions for interior work and equipment leasing. To address issues like staff shortages and internal controls, we introduced partner firms and provided tailored solutions in line with management strategies to support our customers’ growth. Through a wide range of introductions tailored to customer needs, we facilitated 1,768 cases of business matching in FY2023.

Support for mature companies

We are promoting initiatives to support business succession for mature stage companies In FY2023, for example, we provided M&A as a third-party succession solution for customers in the transportation business who lacked a successor. The customer’s wish was to sustain the business and ensure continued employment for staff, creating a company where employees continue to work with confidence. Using wideranging information and insights gathered by the Higashi-Nippon Bank, we met that need by finding a suitable partner and enabling the share transfer. We also enabled buyers to internalize their logistics departments, meeting the needs of both parties. As a result of these efforts, 18 M&A deals triggered by business succession needs were concluded in FY2023.