Efforts to Address Climate Change and Nature-Related Issues(Response to TCFD and TNFD)

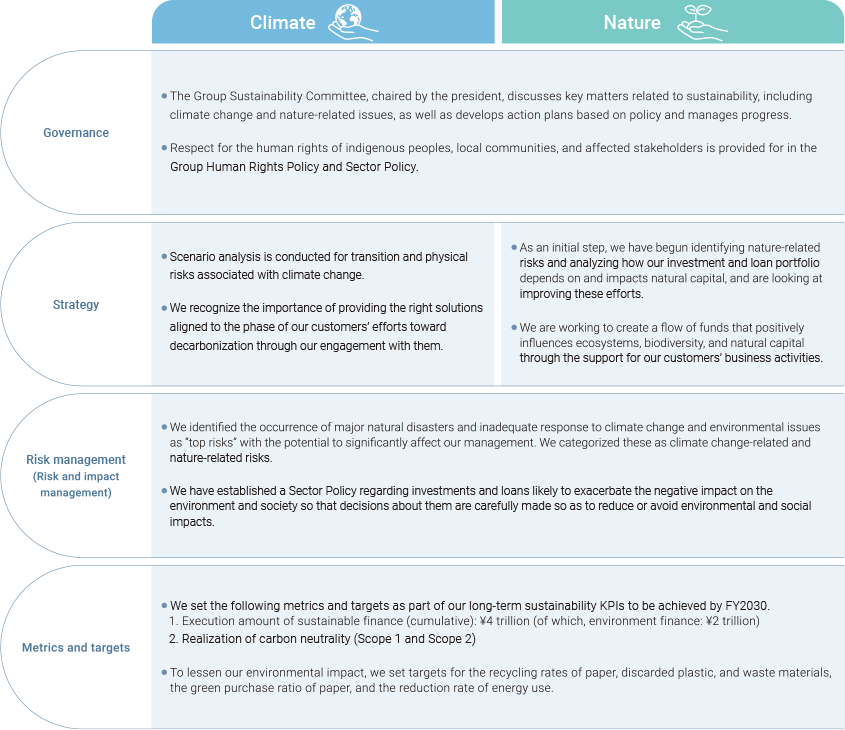

The Group recognizes that the preservation and protection of the global environment is an important issue whose solution must be given a priority. Since endorsing the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD)(*1) in December 2019, we have disclosed information in accordance with its disclosure framework. In addition, in February 2024, we joined the TNFD (Taskforce on Nature-related Financial Disclosures)(*2) forum and are studying how to adopt disclosure practices that align with the framework.

- ※1Task Force on Climate-Related Financial Disclosures: A private-sector-led task force established by the Financial Stability Board (FSB) in December 2015 to encourage companies to disclose climate-related information

- ※2Task Force on Nature-related Financial Disclosures: A private-sector-led initiative launched in June 2021 to encourage companies to disclose nature-related information

The same icons found in the table are placed at the start of main topics or sections (Climate: aligns with TCFD recommendations; Nature: aligns with TNFD recommendations). We view our efforts on climate change and natur e-related issues as inseparable, with many shared elements. We provide this reference information to show stakeholders in an easy-to-understand manner how we are meeting TCFD and TNFD recommendations in our disclosure.

Governance

Strategy

The Earth’s environment, on which human life and business activity depend, is being altered by climate change. Natural disasters and extreme weather are becoming more severe, threatening the sustainable development of communities and businesses.Against this backdrop, efforts towards transitioning to a decarbonized society are advancing rapidly.

In the process of transitioning to a decarbonized society, there are expected to be significant changes in the economy and society, such as stricter policies and regulations in countries throughout the world to achieve carbon neutrality, technological innovation to mitigate climate change, and changes in the values of consumers and investors as a result of greater interest in climate change. We recognize that these changes will lead to both risks and opportunities for the Group, and thus we are examining the impact that the climate-change-driven transition to a decarbonized society will have on our business, while formulating and implementing strategies for responding to climate change in order to handle these risks and opportunities.

In addition, we aim to properly manage risks around natural capital while offering financial products and services related to natural capital to seize business opportunities.

1. Risk

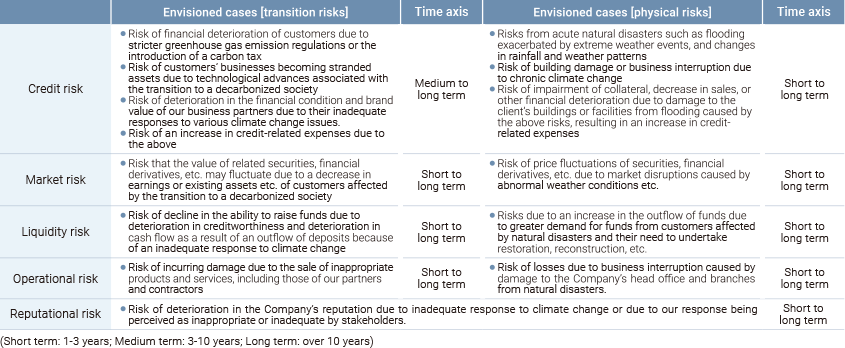

Risks related to climate change

The Group is working to identify and assess two types of risks related to climate change in line with TCFD recommendations — that is, risks associated with the tr ansition to a decarbonized society (transition risks) and risks associated with se vere natural disasters and extreme weather events (physical risks). Transition risks and physical risks for each of the risks that the Group categorizes and manages (credit risk, market risk, liquidity risk, operational risk, and reputational risk) are as follows.

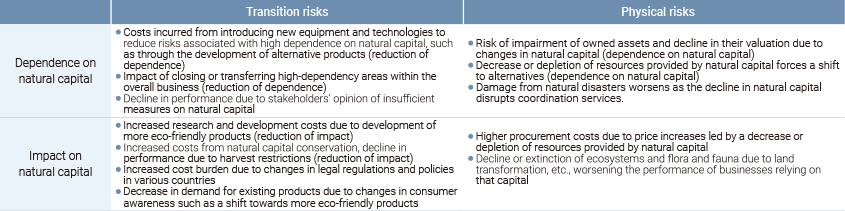

Nature-related risks

In order to understand the relationship between our business and natural capital, our group first organized the nature-related risks of our customers from the perspectives of dependency and impact. The risks we have identified are preliminary, based on our current analysis. We aim to deepen our understanding of the links between our customers and natural capital and how they depend on and affect each other. This will help us more accurately identify potential risk events and enhance our risk awareness.

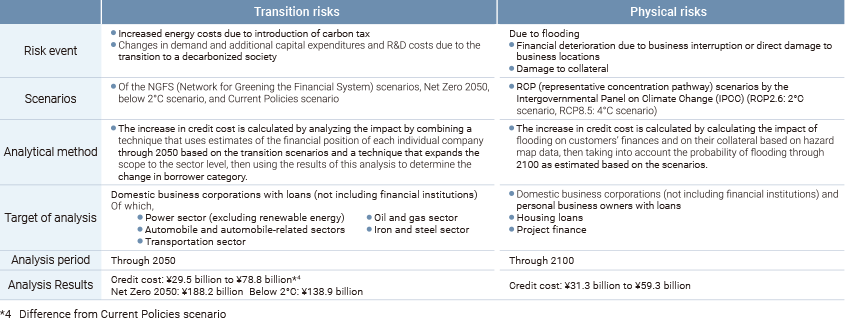

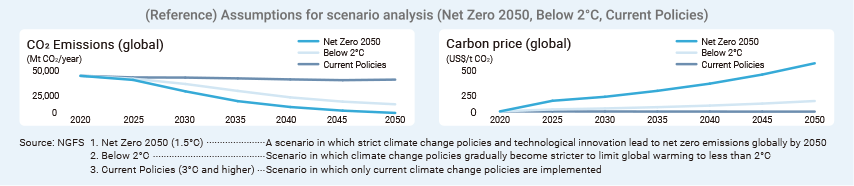

Implementation of Scenario Analysis on climate change

Scenario analysis was conducted for transition and physical risks under certain scenarios based on TCFD recommendations. The results of the analysis conducted in FY2024 are as follows.

Last fiscal year’s analysis of transition risks included the following sectors: electrical power, automotive, automotive-related,*1oil and gas, and steel. This fiscal year, we added the transportation sector,*2which is closely related to those sectors. In our scenario analysis, we examined risk events such as the introduction of carbon taxes due to climate change, rising energy costs due to shifts in the energy mix,*3and higher costs from GHG emission regulations. We also took into account the effects that related sectors have on each other as we did last y ear, and considered the implications of a decarboniz ed society for changes in steel market conditions, impacts on automobile manufacturers, and changes in supply chain tr ansport distances. We based this analysis on variations in electricity prices and supply and demand stemming from shifts in the energy environment. We will continue to increase the sophistication of our analytical methods and to refine them.

Considering the impact of recent river flooding and other disasters in our oper ating areas, we included flood disasters in the physical risk analysis. In addition to domestic companies and sole proprietors, which we covered in our analysis last y ear, we expanded the scope to include project finance, which is vulnerable to natural disasters, and housing loans. We also refined the location data for each site to enhance our analysis.

- *1Automobile-related: auto parts, gas stations, etc. *2 Transportation sector: Marine transportation, rail transportation, trucking services, etc.

- *3Energy mix: Optimizing the composition of power sour ces (thermal, hydro, nuclear, renewable energy, etc.) with an emphasis on economy, environment, supply stability, and safety in power generation

Results of the scenario analysis on climate change

For transition risks, credit costs increased ¥78.8 billion for the Net Zero 2050 scenario and ¥29.5 billion for the Below 2°C scenario compared to the Current Policies scenario, which assumes the continuation of current policies. Credit costs for physical risks are ¥31.3 billion to ¥59.3 billion. We expanded the scope of our analysis for both transition risks and physical risks, which led to an increase in credit costs compared to past results. However, the impact on the Group’s financials is limited.

We will continue to expand the target sectors and increase the sophistication of our scenario analysis, and we will work to reduce these risks with decarbonization initiatives through engagement with our customers.

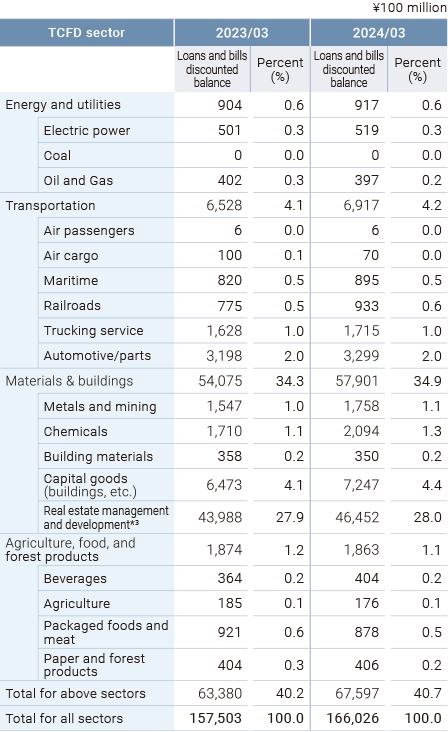

Carbon-related assets

One of the Group’s efforts to ascertain climate change risk is to calculate the loans and bills discounted balance(*1)of carbonrelated assets for FY2023 based on TCFD recommendations, and the results are shown in the table on the right. Since FY2021, separate from carbon-related assets, the Concordia Financial Group has identified eight industries as carbon-related sectors(*2), industries recognized for significant climate change impacts, and monitors them. The share of the credit balance of the relevant sectors at the end of FY2023 in the total loans and bills discounted for all sectors remained at the same level as the previous year, at 2.5%. We will continue to manage risks by monitoring the impact of climate change through our engagement in carbon-related sectors and by increasing the sophistication of our analysis.

- *1Based on the revised 2021 TCFD proposal, the loans and bills discounted balance includes loans and bills discounted, acceptances, guarantees, etc.

- *2Eight industries: iron and steel; electricity, gas, heat supply, and water; fiber; petroleum & coal; ceramics and earthenware; pulp and paper; mining, quarrying and gravel extraction; and nonferrous metals Carbonrelated sectors are classified using Bank of Japan industry sectors and may differ from NZBA sectors.

- *3Real estate management and development includes personal apartment loans etc.

Analysis of dependencies and impacts on natural capital within our investment and loan portfolio

To better understand the links between our operations and natural capital, we first analyzed our corporate customers. Specifically, we used ENCORE (Exploring Natural Capital Opportunities, Risks and Exposure),*a natural-related risk analysis tool recommended in the TNFD framework, to analyze how each sector depends on and affects natural capital.

The analysis revealed that, across various sectors, there is a high dependence on water-related ecosystem services like surface water and groundwater. Water resources are widely used not only in manufacturing processes but also in a broad range of business activities. The Group’s portfolio is heavily weighted toward the real estate business, which relies on surface water including lakes, ponds, and rivers to maintain landscapes and living environments.

We also found that business activities in many sectors affect natural capital through GHG emissions and water pollution. Significant impacts on natural capital are recognized in the following areas: the energy and utilities sector causes soil pollution through mining and large-scale infrastructure development; the metals and mining sector impacts water usage during manufacturing; and construction and real estate businesses affect land ecosystems through factory building and housing developments.

Going forward, we will enhance our analysis by including the findings from ENCORE and identifying key sectors and natural capital that require priority action.

- *ENCORE: A tool to measure how a business affects and depends on nature

2. Opportunities

The Japanese government has set a goal of achieving carbon neutrality by 2050, and is encouraging companies and industries to reduce their carbon footprints. Achieving such a goal may give rise to a need for support in various areas such as significantly reducing GHG emissions, making capital investments in renewable energy, restructuring businesses to boost competitiveness at home and abroad, and creating new ventures. We also see opportunities to offer financial services that help our customers ensure their businesses are nature positive.

Therefore, we believe that by proactively helping customers address climate change and nature capital-related concerns through engagement with them as part of our efforts to support their core businesses, their business foundation will be strengthened, leading to growth opportunities and business stability for our Group itself.

We recognize that by offering the Group’s various financial services in our role as a financial institution, we can help tackle environmental issues and support the sustainable growth of local communities. The main initiatives based on this recognition are as follows.

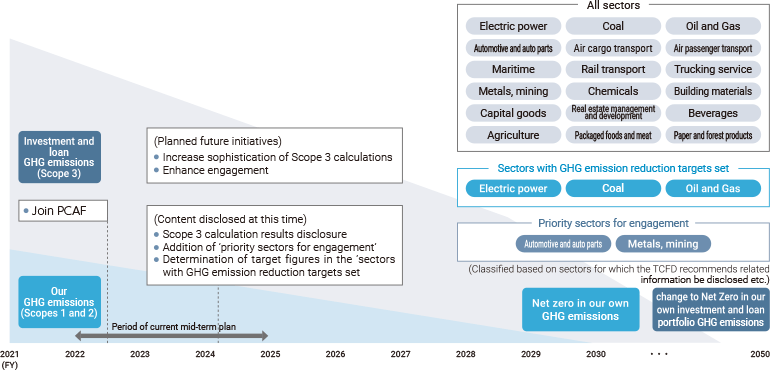

Initiatives to achieve net zero GHG emissions in the investment and loan portfolio

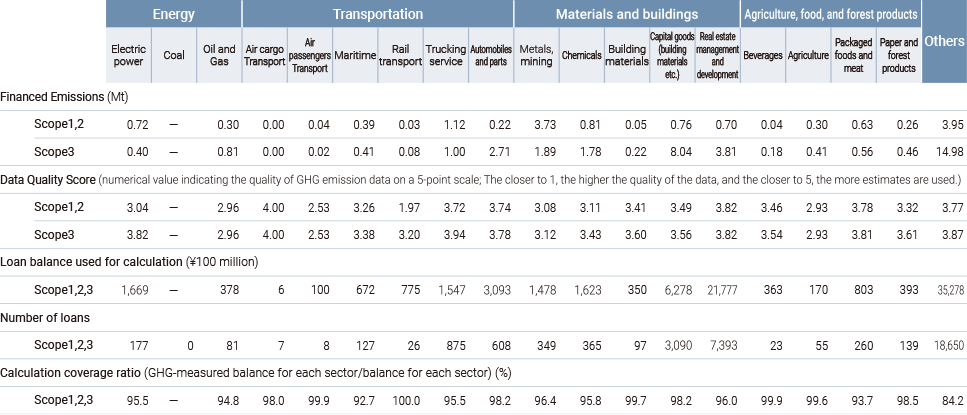

Calculating GHG emissions for our investment and loan portfolio

In FY2022, we joined the Partnership for Carbon Accounting Financials (PCAF), an international initiative to promote the measurement and disclosure of GHG emissions in investment and lending portfolios. Based on the PCAF standards, we calculated the GHG emissions (Financed Emissions) in our investment and loan portfolio, covering corporate loans and project finance. Additionally, we support the direction outlined in the “GX League* Basic Concept” established by the Ministry of Economy, Trade and Industry. As a participating company in the GX League, we are committed to reducing our own emissions while engaging in dialogue with participating companies and participating in discussions on rule-making to promote decarbonization initiatives across the supply chain. In September 2024, we set a target to achieve "net-zero GHG emissions in the investment and lending portfolio by 2050," thereby strengthening our support for customers' efforts towards decarbonization.

Going forward, we will continue to contribute to achieving carbon neutrality by fostering a positive cycle between the environment, economy, and society, while addressing climate change and other environmental challenges.

*The GX League is an initiative where a "group of companies" actively working on GX (Green Transformation) collaborates with participants from government, academia, and finance to collectively engage in discussions to transform the entire economic and social system, and to take practical actions to create new markets.(GX League Basic Concept)

(Preconditions etc.)

- The scope includes corporate loans and project finance as of the end of FY2022, classified based on sectors and other items recommended for disclosure by TCFD recommendations. We have excluded customers that lack the necessary data for calculation.

- Calculations are based on PCAF standards and utilize data disclosed by companies, CDP data, etc. If data is not available, estimates are made using emission coefficients and other data taken from the PCAF database. Note that the PCAF database does not include emission coefficients downstream of Scope 3.

- Financed emissions = Attribute coefficient x GHG emissions of the financed project (Attribute coefficient: amount of investment/each customer’s/project’s debt + equity)

- Calculation results may change significantly in the future for any of a number of reasons, including broader disclosure of customers’ GHG emissions, changes in PCAF calculation standards, and changes in industry classification.

Engagement with customers to achieve net zero GHG emissions for our investment and loan portfolio

Based on the results of the GHG emissions calculations for our investment and loan portfolio, we developed an action plan to help our customers reduce their GHG emissions toward net zero emissions Concrete details are as follows.

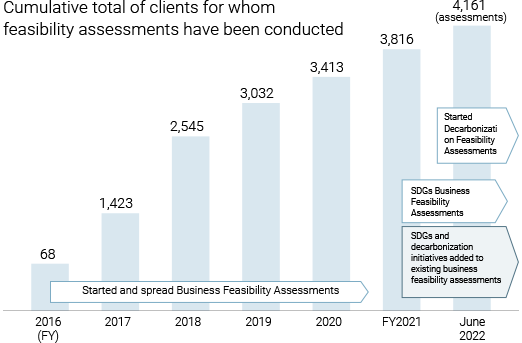

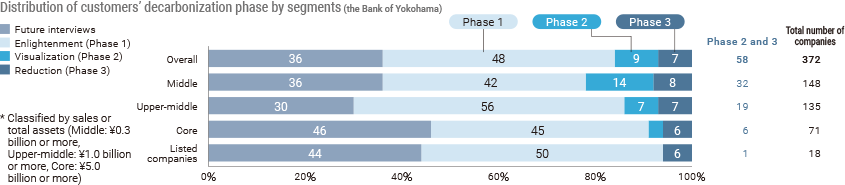

①All sectors

Since FY2016, we have engaged with our customers to resolve their business challenges through business feasibility assessments.(*1)This service has taken root and more than 4,000 companies have had business feasibility assessments through FY2022. In April 2022, we introduced SDGs business feasibility assessments(*2), a more advanced business feasibility assessment, and in December 2022, we launched decarbonization business feasibility assessments, which focus on customers’ management issues related to decarbonization. With decarbonization business feasibility assessments, we engage with customers using a newly created Decarbonization Check Sheet to organize and share management issues related to decarbonization, including visualizing GHG emissions. Through this type of engagement, we will continue to provide optimal solutions for our customers’ business challenges and support their sustainability management, including decarbonization.

- *1This is an initiative to assess a customer’s business and growth potential without relying on financial data.

- *2This is an initiative to score items related to SDGs that were newly added to business feasibility assessments and to tie them to strategic planning and policy proposals.

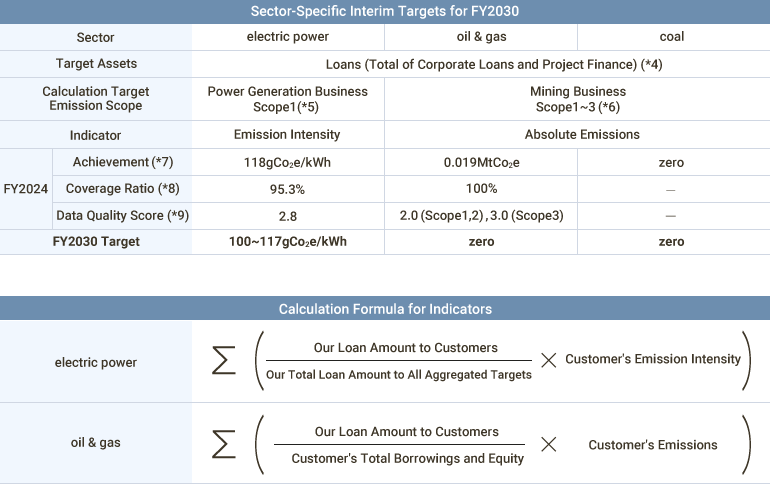

②Sectors with GHG emission reduction targets set

The electric power, coal, and oil & gas sectors are designated as carbon-intensive sectors(*2)by the NZBA(*1)and are sectors with high carbon intensity in the Group’s portfolio, so these three sectors were selected as “sectors for GHG emission reduction targets”.

In September 2024, we set an interim targets for FY2030 for the electric power, coal, and oil & gas sectors along with the target of achieving "net-zero GHG emissions in the investment and lending portfolio by 2050." The interim target values are set well below the benchmark scenarios(*3)based on a detailed analysis of GHG emissions in our investment and lending portfolio, in accordance with the PCAF methodologies.

- *1NZBA: Net-Zero Banking Alliance International initiative for banks to achieve net zero GHG emissions in their investment and loan portfolios by 2050

- *2Carbon-intensive sectors: electricity, coal, oil and gas, transportation, aluminum, iron and steel, cement, commercial and residential real estate, agriculture

- *3IEA NZE2050 (Net Zero Emissions by 2050) and IEA SDS (Sustainable Development Scenario)

- *4Includes payment commitments

- *5Among the companies classified in the target sector, companies with power generation operations are considered target companies, and the Scope 1 emissions of these companies are subject to calculation

- *6Among the companies classified in the target sector, companies with mining operations are considered target companies, and the Scope 1 to 3 emissions of these companies are subject to calculation

- *7Calculated based on the balance as of the end of March 2023

- *8The ratio of the balance for which calculations were actually performed to the total balance subject to calculation

- *9Data quality score as defined by PCAF

③Priority sectors for engagement

- Automobiles and parts

- The metals and mining

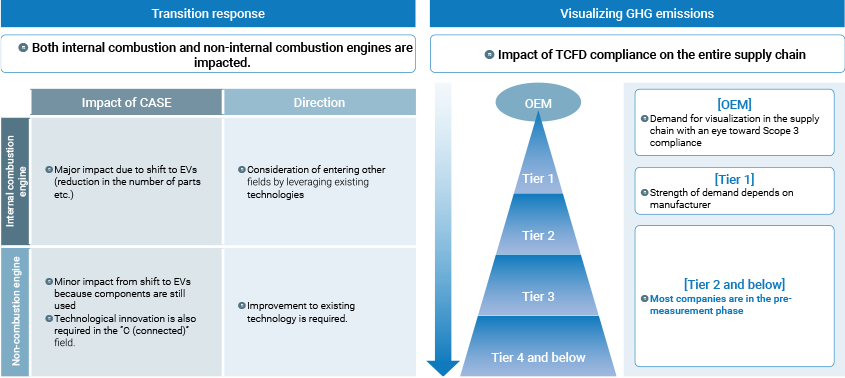

The automotive and parts sector has led the way in analyzing scenarios for transition risks and engaging with the industry’s outlook. Since the supply chain is extensive and decarbonization efforts are expected to take a long time, we designated it as a priority sector for engagement in the last fiscal year. In FY2023, as for activities in this sector, we engaged with customers to understand their external environment and their efforts on decarbonization management. As a result, about 20% of companies identified visualization and reduction of GHG emissions as challenges. We expect growing requests from the companies in our customers’ supply chains to cut carbon. We will therefore continue to provide our customers with the support they need for visualizing GHG emissions and setting reduction targets.

The metals and mining sector includes steelmaking, metal products, and non-ferrous metal manufacturing. It uses a lot of energy such as heat and electricity in its manufacturing processes, making it a sector with relatively high GHG emissions. The Group has newly designated this sector as a priority sector for engagement to better support customers adapting to changes in the business environment during the transition to a decarbonized society. We will share business strategies and management challenges through engagement and support customers on visualization of GHG emissions and setting reduction targets.

Engagement with automotive suppliers

We selected the automotive and auto parts sector, one of the first sectors we engaged with in transitional risk scenario analysis and industry outlook, as a priority sector for engagement because of its broad supply chain and the long time required for decarbonization efforts. We expect these efforts to spread throughout the whole supply chain and we promote engagement from upstream customers and provide support for activities such as visualizing GHG emissions and setting reduction goals.

The executive in charge of the Bank of Yokohama’s Sales Division engaged with the management of several primary subcontractors that manufacture internal combustion engines and non-internal combustion engines in the automobile industry regarding their awareness of the shift to EVs, the challenges involved, demand for visualizing GHG emissions, and the status of their response to that demand.

Through this engagement, we shared with customers in the automotive industry that for both internal combustion and non-internal combustion engines, in addition to CASE(*)and other transition responses, visualizing GHG emissions is a major issue for the entire supply chain.

Although the depth and speed of the demand on the entire supply chain for visualizing GHG emissions depends on the OEM (completed vehicle manufacturer), it is expected that demands for such visualization will grow stronger in the future, and that the impact will spread throughout the entire automotive industry.

We will work to ascertain and share our customers’ challenges and work to mitigate the impact of climate change and support their transition by continuing this type of engagement.

- *1CASE: Technological innovation in new areas such as Connected cars (IoT), Autonomous/automated driving, Shared cars, and Electric vehicles.

Future roadmap toward net zero GHG emissions

To achieve net zero emissions, we will accelerate our own GHG emission reduction initiatives and those of the companies we invest in and lend to.

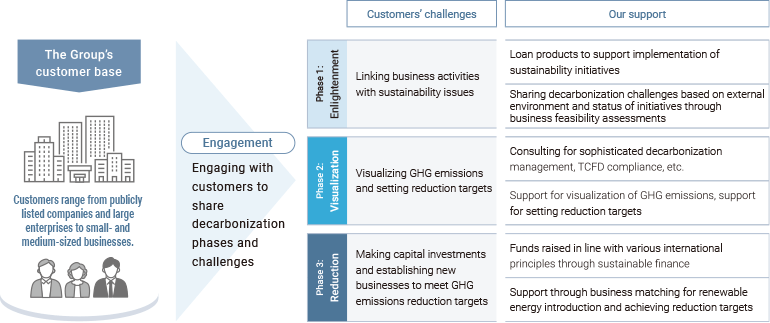

Providing optimal solutions for the phase of the customer’s initiative

The Concordia Financial Group conducts business with a wide range of customers, including SMEs, listed companies located upstream in the supply chain, and regional core companies. Through engagement with these customers, we share information on issues related to mitigating transition risks and physical risks and to expanding growth opportunities, we work to expand our lineup of solutions that help customers resolve their problems, and we recognize the importance of providing optimal solutions tailored to each customer’s phase of initiatives. The support system and lineup of our main solutions for the particular phase of the customer’s initiatives are as follows.

Main Sustainable Finance Lineup

- *1The Group actively supports public policies related to climate change and energy consumption reduction. For example, in support of the "Business Activity Global Warming Countermeasure Plan System" by local governments and to promote initiatives based on this system, we are collaborating with Kanagawa Prefecture to implement the "Business Activity Global Warming Countermeasure-Linked Loan," as a concrete action. This initiative supports customers who are working to reduce greenhouse gas emissions.

Initiatives to support customer business activities toward becoming nature positive

Throughout the Group, we strive to provide financial services that support our customers’ business activities, creating financial flows that positively impact ecosystems, biodiversity, and natural capital. We will work to support our customers in their efforts to conserve and restore natural capital so that they can become nature positive.

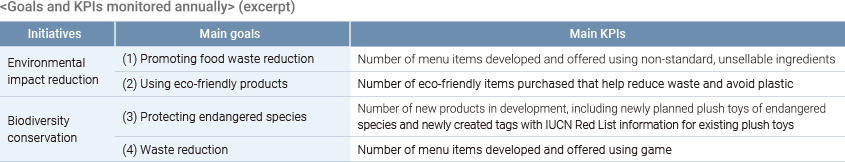

(Customer case study) The Initiatives of Positive Impact Finance

The Bank of Yokohama provided a loan to AQUA Inc. through Positive Impact Finance (PIF).AQUA (Headquarters: Yokohama City) manufactures and sells plush toys and sundry goods. It also runs shops and restaurants in aquariums and zoos. Through its green business activities, AQUA works to preserve biodiversity, raise awareness, and actively use eco-friendly products and materials.

AQUA is working to reduce its environmental impact in various ways. For example, it is developing menus that use non-standard ingredients to cut food waste. It is also adopting eco-friendly products made from bamboo fibers that do not release harmful substances like dioxins when burned.

AQUA also helps raise awareness about endangered species by selling plush toys and provides support for conservation efforts by donating part of the proceeds to the IUCN-J (Japan Committee of the International Union for Conservation of Nature). In addition, it offers game dishes using culled deer and boar to prevent wildlife damage, providing a chance to reflect on human-animal relationships and reducing waste by using unused farm products.

The Bank of Yokohama carried out a comprehensive assessment of the environmental, social, and economic impacts of AQUA’s operations through PIF. By regularly monitoring the following KPIs against established goals, it helped address social and environmental issues.

Initiatives to achieve net zero GHG emissions in our own business activities

As a member of the local community, we have set “achieving carbon neutrality (Scopes 1 and 2) by FY2030” as a long-term sustainability KPIs in order to actively promote local decarbonization. We are working to achieve this goal through energy conservation, through switching to virtual renewable energy for power we contract for our own use, and through other initiatives. By April 2023, we converted all of the Group’s own electricity contracts to virtual renewable energy. We will continue to work towards achieving our goals.

Sustainability initiatives: Installing a solar power plant on a company-owned property (January 2024)

The Bank of Yokohama has installed a solar power plant at the Yamato General Ground, which it owns, and has begun supplying electricity to its own properties, aiming to achieve carbon neutrality by FY2030. The annual power generation is expected to be about 94,000kWh. The generated electricity is supplied to the Bank of Yokohama Yokodai Branch and the YBS Nanko Building, which is owned by the Bank of Yokohama.

Risk management

Within the Group, each subsidiary has set up a risk control department as well as a risk management department for each type of risk, thereby identifying, evaluating, and managing risks. The Risk Management Department at the holding company comprehensively manages risks for the entire Group, and an officer in charge of risk, who is separate from the General Manager of the Audit Department, regularly reports on the risk status to the President and Representative Director and the Board of Directors.

Top risks

We assess risks that could greatly affect the Group’s operations, judging their significance by impact and likelihood. The Board of Directors then identifies the most critical risks as “top risks”. For top risks, we set Key Risk Indicators (KRIs) and monitor them continuously to spot early warning signs. We have also arranged systems to respond swiftly if a risk becomes evident. We recognize climate change and nature-related risks as top risks, as outlined below.

| Occurrence of major natural disasters | ・Major earthquakes ・Eruption of Mount Fuji ・Climate change-driven typhoons and flood As a result of the paralysis of capital city functions and financial markets caused by natural disasters, the business conditions of counterparties have deteriorated. |

|---|

We will continue to work to build a system that enables us to manage these risks within the comprehensive risk management framework.

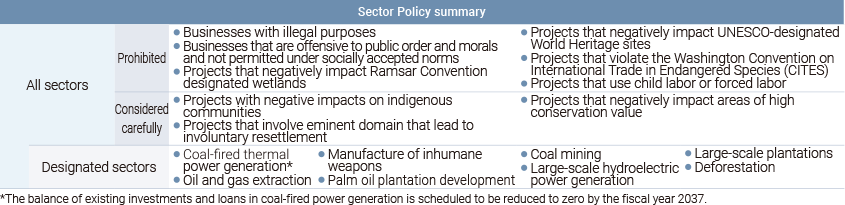

Sector policy

The Concordia Financial Group has established a Sector Policy regarding investments and loans likely to exacerbate the negative impact on the environment and society so that decisions about them are carefully made so as to reduce or avoid environmental and social impacts. We work to reduce and avoid negative impacts on the environment and society through our policy on investment and lending. We identify businesses in sectors where we ban or restrict investment and lending, and also have guidelines for certain sectors like coal-fired power generation and coal mining. The Group Sustainability Committee regularly reviews the need to update this Sector Policy. We also revise it as necessary based on changes in our business activities or the external environment.

- ※The balance of existing investments and loans in coal-fired power generation is scheduled to be reduced to zero by the fiscal year 2037.

Indicators and Targets

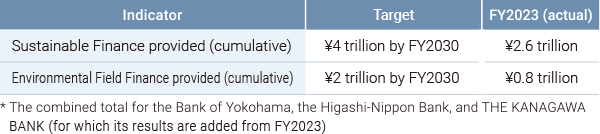

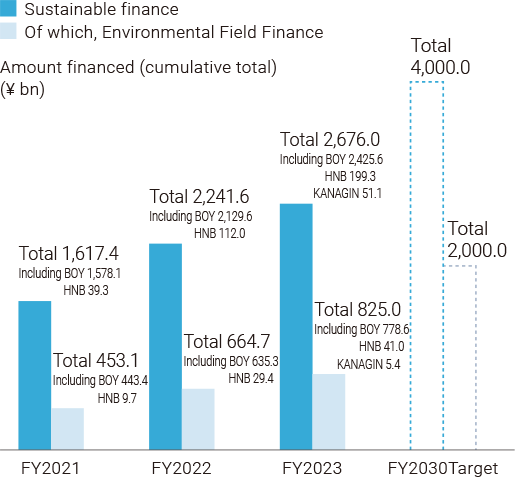

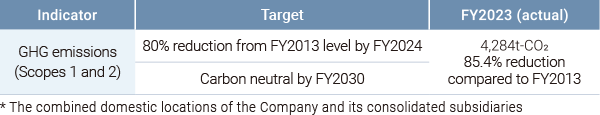

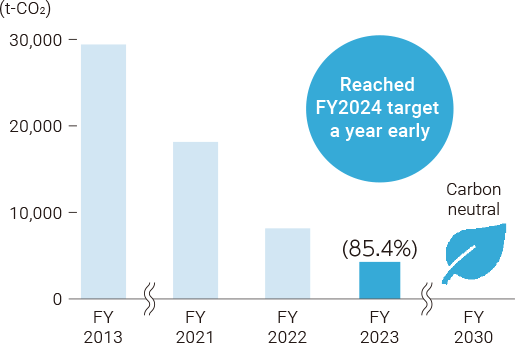

The Group has set targets for Sustainable Finance, Environmental Field Finance, and GHG emission reductions as long-term sustainability KPIs related to Measures against Global Warming and Climate Change.

Sustainable Finance and Environmental Field Finance

In order to strengthen solutions to the environmental and social issues faced by our customers, including solutions for addressing climate change, and to contribute to the sustainable growth of our local customers, we have set targets for the cumulative amount of Sustainable Finance and Environmental Field Finance as long-term sustainability KPIs. Since the Group reached its target for the cumulative amount of Sustainable Finance (¥2 trillion by FY2030) by the end of FY2022, we raised the target to ¥4 trillion (¥2 trillion more) in Sustainable Finance by FY2030, including ¥2 trillion (¥1 trillion mor e) in finance to the Environmental Field.

GHG emissions from our own business activities

As a member of the local community, we have set “achieving carbon neutrality (Scopes 1 and 2) by FY2030” as a long-term sustainability KPI in order to actively promote local decarbonization. By switching our contracted electricity to substantial renewable energy, we cut our FY2023 GHG emissions by 85.4% from FY2013 levels, reaching our reduction target a year early.

GHG emissions calculation and third-party verification

For FY2023, the scope of calculation of the Gr oup’s GHG emissions for Scope 1 and 2 is the Company and its consolidated subsidiaries. For Scope 3, the scope of calculation includes the Company , the Bank of Yokohama, the Higashi-Nippon Bank, and THE KANAGAWA BANK. We measure all 15 categories. Since FY2021, the GHG emissions of the Bank of Yokohama and the Higashi-Nippon Bank have undergone third-party verification by the Japan Quality Assurance Organization. In FY2022, this verification was expanded to include the Company and its consolidated subsidiaries. We will continue to improve and refine our calculation methods.

Initiatives to reduce the environmental impact of our business activities

Our Group Environmental Policy sets out to promote resource and energy saving, waste recycling, and efforts to lessen our environmental impact. In our effor t to reduce our environmental impact, at the Bank of Yokohama and the Higashi-Nippon Bank, we set targets for the recycling rates of paper, discarded plastic, and waste materials, the green purchase ratio of paper, and the reduction rate of energy use.