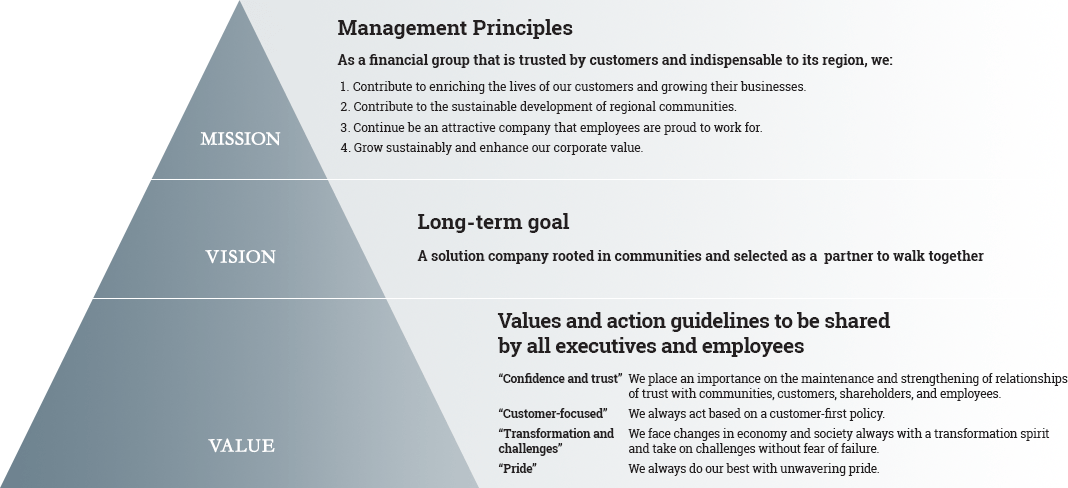

Management Policy

1. Long-term Goal

A solution company rooted in communities and selected as a partner to walk together

Thoughts underscored in the “Long-term goal”

- In order for us to continue to be “a financial group that is indispensable to its region” as set forth in our Management Principles, we aim to become a “solution company” that provides solutions to solve issues of customers and regional communities by broadening the range and increasing the quality of our solutions.

- Our commitment to becoming the closest partner for customers and regional communities by sincerely addressing issues faced by them is expressed in the phrase “rooted in communities and selected as a partner to walk together.”

- Aiming to become such a “solution company,” we will contribute to sustainable development of vibrant regional communities.

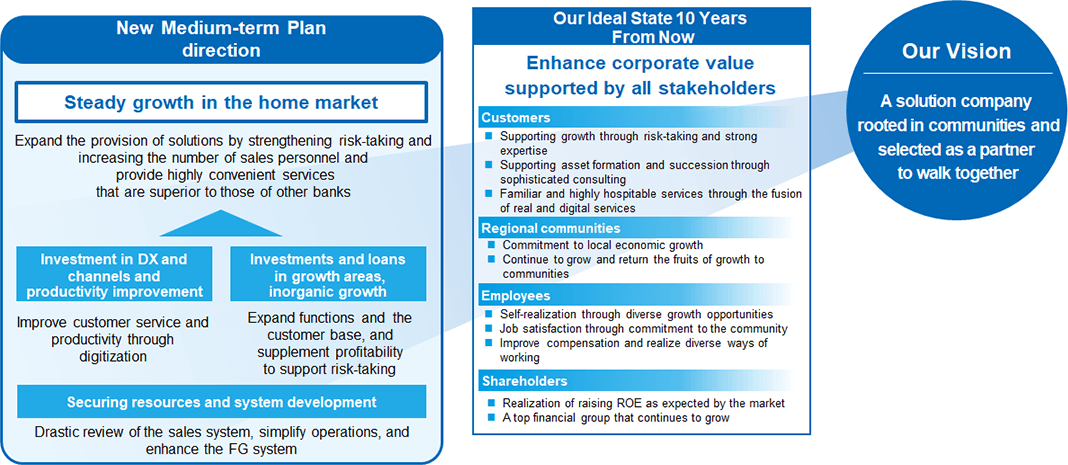

Our Ideal State 10 Years From Now

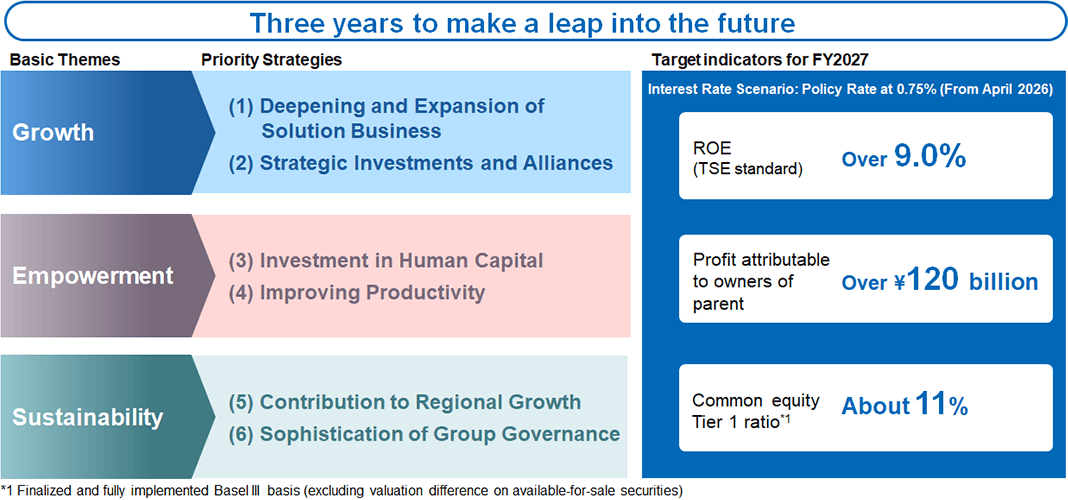

Overview of the Medium-term Management Plan(FY2025~FY2027)

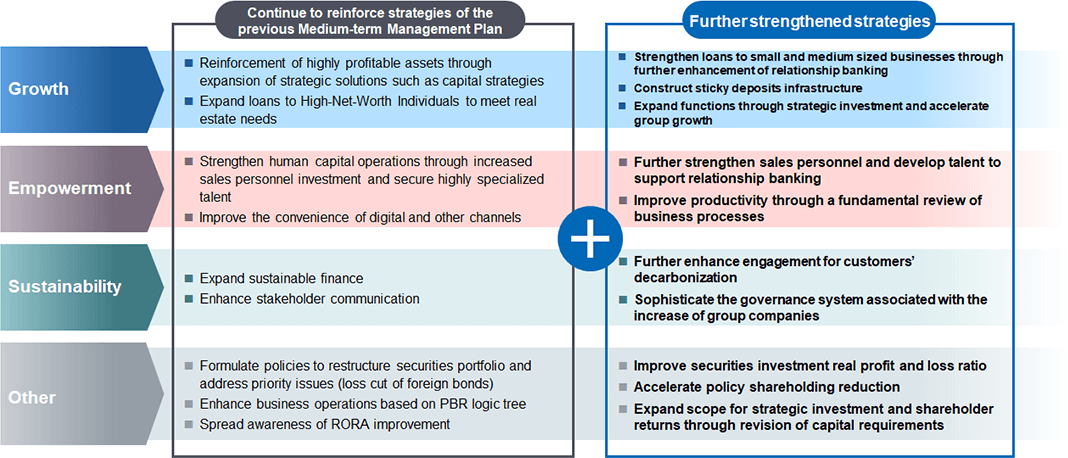

Strategic Points