Customer-Focused Business Operations

Policy on Initiatives

As part of our commitment to customer-oriented business operations, we have formulated and published our “Declaration of Fiduciary Duty”, which was approved by the Board of Directors. The Bank of Yokohama, the Higashi-Nippon Bank, and THE KANAGAWA BANK have adopted a policy based on this Declaration and are working to conduct customer-focused business operations.

Fiduciary Duty Declaration

Customer-oriented Support for Asset Formation and Management

1.The Group shall focus on its customers and support the formation of portfolios that are consistent with their true needs and interests.

- In light of the customer’s asset and liability situation, knowledge, experience, and objectives of asset formation and management, we will consider an appropriate portfolio based on each customer’s life plan and other factors, and propose products and services that meet their needs.

- The Group shall provide support that contributes to customers’ investment returns over the medium- to long-term.

Provision of Optimal Products and Services

2.After accurately identifying customers’ needs, the Group shall provide products and services that create real profit for its customers. We will also build and implement a product governance system to achieve this.

- The Group shall prepare a wide range of products and services to allow it to fulfill the various needs of its customers.

- The Group shall appropriately conduct quality control in each process of development, selection, provision, and management of products and services, and develop a system to ensure the effectiveness of these processes.

- The Group shall collaborate with product development companies (or the development divisions in the case of in-house product development) to provide products and services that will truly benefit our customers through the integration of production and sales.

Provision of Information to Customers

3.The Group shall accurately and promptly inform customers of information related to products and services as well as market trends and other information.

- When making proposals to customers, we use various pamphlets and IT tools to explain important information related to products and services in a way that is easy to understand even for customers with little investment experience by using simple terms and expressions.

- For customers to fully understand the characteristics and risks of the products we propose, we will explain them in an easy-to-understand and careful manner according to the complexity and degree of risk of the product, using comparative materials designed to facilitate easy comparison with similar products.

- To help customers make investment decisions, we will improve transparency by providing information on various fees and commissions.

- By providing information on the status of owned assets and market trends, we will provide timely and appropriate after-sales service in accordance with the purpose of each customer's asset formation and management, that also considers the long-term perspective.

- The Group shall promote support for financial education to improve the financial literacy of local communities.

Appropriate Management of Conflicts of Interest

4.The Group shall appropriately manage the selection of products and provision of information to customers, to ensure that customers’ interests are not unfairly harmed.

- The Group shall select high quality products and provide appropriate products to customers, without bias based on fees paid by companies providing products or being Group companies’ products.

Creation of a Structure that Prioritizes Customer Satisfaction

5.The Group shall create an appropriate customer-oriented sales structure and establish systems to verify its effectiveness.

- The Group shall create various channels and strive to enhance customer convenience, as well as create an environment where customers can consult with confidence.

- The Group shall build an employee evaluation system that takes into consideration initiatives consistent with the actual needs and interests of customers and relationships of trust with them.

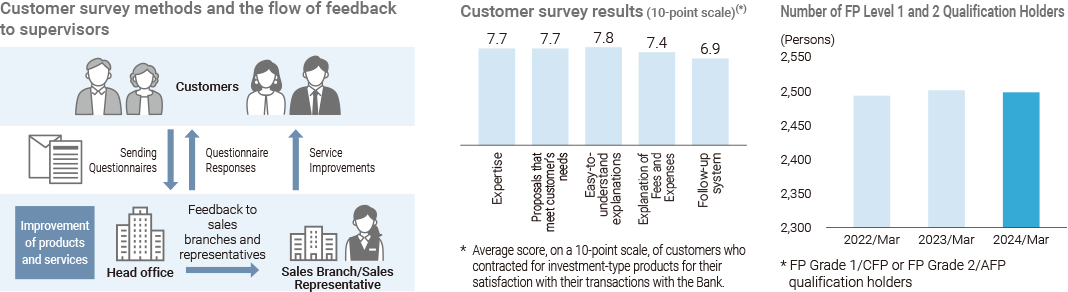

- The Group shall regularly measure customer satisfaction in regard to its products and services, and build internal systems to reflect customer feedback in enhancing products and services.

Training and Securing Personnel

6.Aiming to provide optimal products and services to customers, we will develop human resources with a high level of expertise in the field of finance and cultivate a strong sense of responsibility to meet the expectations of our customers.

- Along with a thorough customer-oriented approach, we will enhance our education and training systems to improve our employees’ expertise and develop human resources with a strong sense of responsibility to fulfill the duties entrusted to us by customers.

- (*)This declaration applies to the following Group companies: The Bank of Yokohama, the Higashi-Nippon Bank, Hamagin Tokai Tokyo Securities, and THE KANAGAWA BANK

Details of Group Initiatives

Each group company has established a department to supervise customer-oriented business operations and a risk management department. The supervising departments oversee overall customer-oriented business operations by formulating annual plans based on the Declaration and report regularly to the Management Committee etc., developing internal systems, reviewing and monitoring products and services, enhancing training, and conducting customer surveys. The risk management departments monitor customeroriented business operations from the perspective of customer protection, ensuring the suitability of product proposals and the provision of information, ensure the suitability and sufficiency of each function through periodic reports to the Board of Directors, and provide guidance for relevant departments. In addition, the Board of Directors of the Group supervises the efforts of each Group company.

In addition to complying with all applicable laws, regulations, and rules in the sale of financial products, we will solicit business appropriately in accordance with the solicitation policies set forth by each company and comply with relevant laws, ordinances, etc. concerning the protection of customers’ personal information and work in accordance with the policies set by the company.

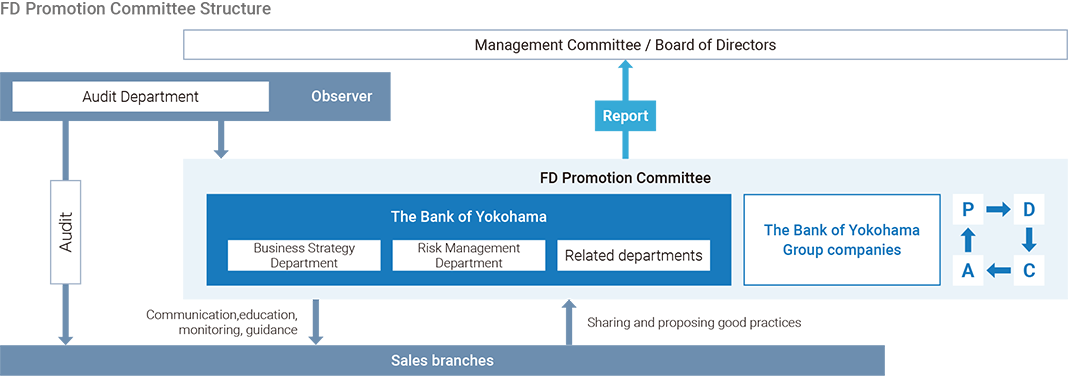

In order to steadily implement customer-focused business operations based on the Declaration, the Bank of Yokohama Group has established an FD Promotion Committee at the Bank’s head office to evaluate and confirm the status of the implementation of fiduciary duties and to hold cross-organizational discussions and considerations regarding necessary responses and improvement measures.

Taking a Stance Prioritizing Customer Satisfaction and Developing and Securing Human Resources

At the Concordia Financial Group, each Group company implements various initiatives to take a stance prioritizing customer satisfaction and developing and securing human resources.

For example, the Bank of Yokohama implements the following initiatives.

Taking a stance prioritizing customer satisfaction

- We conduct an annual customer satisfaction survey to gauge customer satisfaction in order to seek the candid opinions of our customers. We ask our customers to evaluate our efforts directly and use the results to improve our products and services.

- We will continue to improve our efforts to become the bank and staff of choice by offering proposals that contribute to long-term asset development and asset management and by providing regular follow-up services to give customers confidence after purchase (signing of contracts).

Developing and securing human resources

- We conducted training, study sessions, and e-learning related to customer protection and compliance for all employees responsible for individual customers throughout the year to raise awareness.

- We are working to develop human resources with advanced expertise by encouraging staff to acquire qualifications related to customer protection etc. In particular, we are actively working to develop human resources with expertise and skills appropriate for financial professionals by encouraging them to acquire FP (financial planner) qualifications. We are focusing especially on increasing the number of people obtaining FP Grade 1 and CFP qualifications, and the number of new qualification holders is increasing year by year, with 49 people in FY2023 and 71 people in FY2024.

- We reflect the status of our efforts for customer-oriented business operations in the personnel evaluations of both management and staff members and are working to raise awareness of customer-oriented business operations from the standpoint of personnel evaluations of both management and staff members.

External Evaluation of Customer-Oriented Initiatives

- The Bank of Yokohama has been recognized for its efforts in selling customer-focused financial instruments, and in July 2025, the Bank received an “SS rating” in the “R&I Customer-Focused Financial Sales Company Evaluation” published by Rating and Investment Information Inc. (R&I), which is a credit rating agency.

Key points of R&I’s evaluation of the Bank of Yokohama (excerpts from the evaluation report)

- 1. Formulation and publication of policies, etc. related to customer-oriented business operations

- Customer-oriented business operation (Fiduciary Duty: FD) is positioned as an important management issue. In April 2024, the FD Promotion Committee was established to strengthen the efforts of the entire Group. Management is more deeply involved in understanding the status of efforts and considering solutions to issues. The Bank's policy on FD includes the newly included concept of providing “true benefit to customers,” and continues to set detailed action plans and implement the PDCA cycle steadily.

- 2. Pursuit of customers’ best interests

- Skill improvements are made with an accurate grasp of proposal skills of each sales representative according to their level of proficiency. Efforts are focused on further improving the quality of proposals by sales staff by introducing contents in which they can learn new market explanatory materials, basic knowledge of investment, and proposal points. The most recent customer survey confirmed that customer satisfaction of sales representatives' explanatory skills has increased.

- 3. Sales policy formulation and sales of financial instruments

- The sale of financial products shall be on a “long-term, diversified, and funded” basis. It aims to share the “purpose” of the fund management with its clients through a goal-based approach and propose a portfolio that contributes to the formation of assets over the medium to long term based on core and satellite strategies. In recent years, careful after-sales follow-ups have been conducted, mainly for customers with long-term unrealized losses. Clients are provided with information to help them review their investment policies, improve their profit and loss situation, and build relationships of trust.

- 4. Ensuring product governance

- Based on the rules set within the bank, investment trusts and insurance products are selected and regularly monitored. In addition, information from external evaluation organizations is also utilized to improve the product lineup. The effectiveness of product governance is enhanced by incorporating 2-line and 3-line verification of proposals and audits into the PDCA cycle in this selection and monitoring, and by reviewing the product and sales management systems.

- 5. Appropriate motivational framework and other initiatives for employees

- In line with the start of the New Medium-term Management Plan, the basic policy was to set targets by accumulating various measures for the realization of FD. For performance evaluation, an evaluation system that emphasizes the balance of assets and the expansion of accumulated investment has been established. The ratio of revenue to total valuation has declined significantly compared to the previous year. Regarding the items constituting personnel evaluations, the system was revised to further strengthen the customer-oriented attitude, such as by maximizing the ratio of evaluations on FD practices.