Corporate Governance

Basic Concepts

We have a Corporate Governance Basic Policy that establishes policies and frameworks for achieving effective corporate governance with the aim of promoting sustainable growth of the Group and improving corporate value over the medium to long term. We constantly review our philosophy of corporate governance and work to improve it.

Furthermore, based on our Management Philosophy, we manage in a way that contributes to value creation for various stakeholders such as shareholders, customers, employees, and local communities, we are ensuring the fairness, transparency, and speed of decision-making, and we are building a corporate governance system appropriate for a regional financial group.

(The content on this page is based on information as of March 1, 2025.)

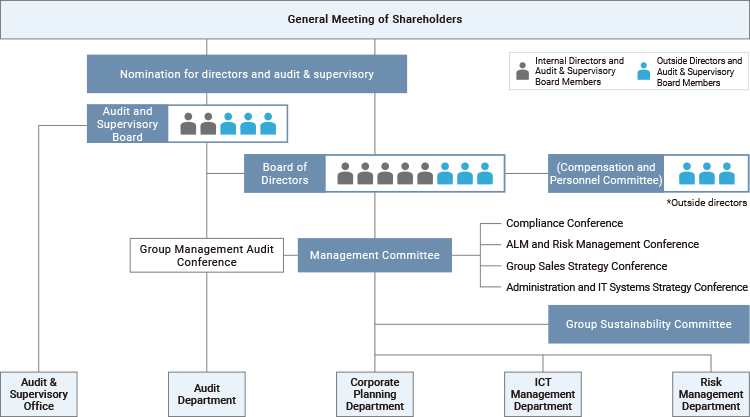

Corporate Governance System

The Company has an Audit and Supervisory Board, and its Board of Directors, auditors, and Audit and Supervisory Board are responsi-ble for supervising management. Auditors, including independent outside auditors, audit the legality and appropriateness of the directors’ execution of their duties by attending meetings of the Board of Directors and reviewing important documents, thereby fulfilling their management auditing function. In addition, independent outside directors supervise management from an independent standpoint and provide opinions and proposals to ensure the appropriateness of decision-making. The Company has adopted the current corporate governance system because it thinks that this system adequately fulfills the auditing and supervisory functions.

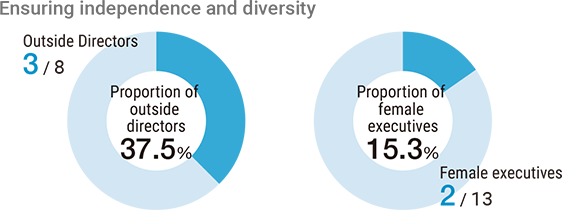

Composition of the Board of Directors and the Audit and Supervisory Board

In order to ensure that the Board of Directors functions most effectively and efficiently, and from the perspective of revitalizing the Board of Directors, the Articles of Incorporation stipulate that the number of directors be no more than 10. In order to ensure the independence of the Board of Directors and to demonstrate that it functions fairly and transparently, the Company appoints a number of outside directors who maintain views that are independent from the Group, making up at least one-third of the members. By combining internal directors who are familiar with the Group’s business with outside directors with extensive experience and knowledge outside the Company and giving the Board of Directors diverse members with different backgrounds of specialist knowledge and experience, different, the group ensures a good balance of knowledge, experience and skills on the Board of Directors.(*) As of June 21, 2024, of the eight directors (seven men and one woman), three are independent outside directors. To ensure the effectiveness of audits, the Articles of Incorporation stipulate that the Audit & Supervisory Board has no more than five members, with at least half being outside members. As of June 21, 2024, of the five Audit & Supervisory Board members (four men and one woman), three are independent from the outside.

- ※We consider ensuring diversity on the board of directors and promoting women’s activities as an important management issue. Regarding the ratio of female executives, we support the Japan Business Federation's 'Challenge to 30% by 2030' and aim to 'achieve a female executive ratio of 30% or more by 2030,' while promoting Diversity, Equity, and Inclusion (DEI) initiatives.

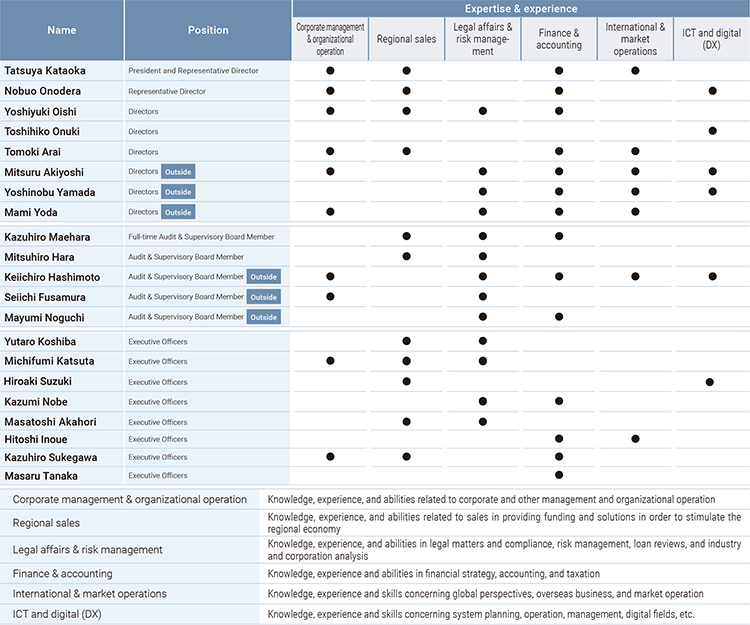

Specialization and experience of directors, Audit & Supervisory Board members, and executive officers (skill matrix)

The specialization and experience required by the Company are considered to be “Regional sales,” which is essential for understanding the business models of subsidiaries that are regional financial Institutions; “Corporate management and organizational operation,” “Legal affairs and risk management,” and “Finance and accounting,” which are universally required for corporate management; “International & market operations” and “IT and digital (DX),” which are required to provide more advanced expertise necessary to respond to the changing business environment; “Sustainability (Environment and Society),” which is required to solve issues in the environmental and social domains in order to enhance corporate value in a sustainable manner; and “Human capital,” which is required to maximize human capital and promote the human resource strategies linked with the Company’s management strategy. The following table presents the details of the combination of skills and the skills possessed by each individual, including the Executive Officers, along with the Directors.

(This section is based on information as of June 20, 2025.)

Board of Directors

The Board of Directors defines the scope of matters to be resolved by the Board of Directors in accordance with the rules of the Board of Directors, clarifies the scope of delegation to the Management Committee and management group, and makes important decisions on policy associated with risk compliance, as well as providing management oversight for more effective management. In addition, with the aim of strengthening collaboration within the Group and improving governance, the Board Meetings of the Company and the Bank of Yokohama operate integrally, and we have put in place a system that allows our directors and Audit & Supervisory Board Members to participate as observers in the Higashi-Nippon Bank’s Board Meetings and other meetings.

Points Discussed at Board of Directors Meetings(FY2023: 14 meetings held)

(1)Management Plan

- Group Management Policy

- Overall Group Budget

- Group Capital Plan

(2)Items related to sustainability

- Review of long-term sustainability KPIs

- Status of response to TCFD Recommendations

- Engagement Strategies for a Net Zero Investment and Loan Portfolio

(3)Items related to corporate governance

- Risk Appetite Statement

- Evaluation of effectiveness of Board of Directors

- Evaluation of internal control system

(4)Risk and compliance matters

- Risk management policy

- Internal audits

- compliance programs

Establishment of annual themes

With the aim of promoting the Company’s sustainable growth and enhancing its corporate value over the medium to long term, we establish “annual themes” for the Board Meetings to enrich strategic discussions.

Annual themes in FY2023

- Revision of disclosure concerning reduction of policy shareholdings

- Disclosure policy for “Annual Securities Report” and “Corporate Governance Report”

- Medium-to long-term direction of group businesses

- Update to strategies for effective use of capital

- Current status and future direction of securities management

- Direction of international strategy

- Approach and direction of shareholder composition

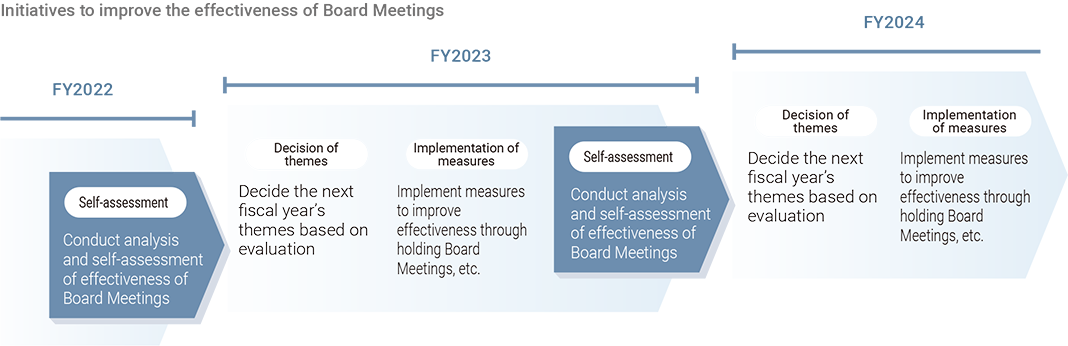

Evaluation of Board of Directors effectiveness

Evaluation method

Our effectiveness assessment is based on questionnaires and interviews from the perspective of utilizing third party viewpoints, the results of which are tabulated and ana-lyzed, before the self-assessment is conducted. The specific assessment method is as follows.

- We had all the directors and auditors, who make up the Board of Directors, complete a questionnaire, which was handled by a third party to ensure objectivity and anonymity.

- Interviews were conducted with each director and Audit & Supervisory Board member in order to confirm and gather specific opinions on the results of the questionnaire.

- After compiling and analyzing the results of 1 and 2 above, the Board of Directors deliberates on and shares about whether the Board of Directors as a whole is effective in light of the roles and responsibilities it should fulfill, and conducts a self-assessment.

Main questionnaire items

- Composition of Board of Directors

- Operation of the Board of Directors

- Discussions at board meetings

- Support system for directors and members of Audit & Supervisory Board

- Engagement with shareholders (investors)

Summary of the Results of the FY2023 Board of Directors Effectiveness Assessment

In FY2023, in light of the roles and responsibilities to be fulfilled by the Board of Directors, we set four themes to be continuously addressed and promoted initiatives to improve the Board Meeting effectiveness. As a result, the Board of Directors conducted and shared a self-assess-ment that “the Board Meetings as a whole continued to be generally effective in FY2023”.

In FY2024, based on the evaluation of effectiveness in FY2023, we will work to further improve the effectiveness of the Board Meetings in order to promote sustainable corporate growth and enhance corporate value over the medium to long term.

For more information on our Board of Directors Effec-tiveness Assessment, please see our Corporate Gover-nance Report.

Themes for action to improve the effectiveness of the Board of Directors in FY2024

- Strengthening discussions of medium-to long-term strat-egies for the enhancement of corporate value

- Raising the level and improving efficiency of Board Meet-ings operations

- Improving monitoring functions

- Strengthening stakeholder communication

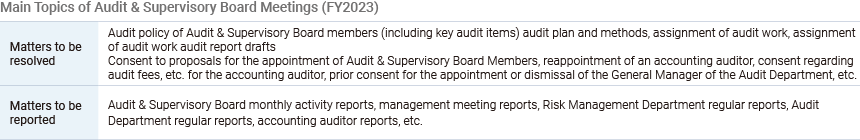

Audit and Supervisory Board

Audit & Supervisory Board members audit the legality and appropriateness of Board of Directors’ business execution by attending important meetings, such as Board of Directors meetings, by examining the state of operations and assets, by reviewing documents related to important decisions, and also by communicating with internal audit and supervisory departments and group companies, and by exchanging information with accounting auditors and similar parties, as stipulated in the audit policy and audit plan set by the Audit & Supervisory Board. In FY2023, we mainly focused audits on the “status of initiatives aimed at sustainable growth and medium-to long-term enhancement of corporate value”, “status of establishment and operation of the Group’s internal control systems”, and “status of synergies from the business integration with THE KANAGAWA BANK and the construction of a risk management system”.

Audit & Supervisory Board Members interview officers and employees of the Company and its subsidiaries and visit subsidiaries’ sales branches to conduct audits, after which they compile their findings and report them to the Board of Directors and the Management Committee.In addition, while discussing key audit matters (KAMs) with the accounting auditors, they receive reports on the status of their audits.

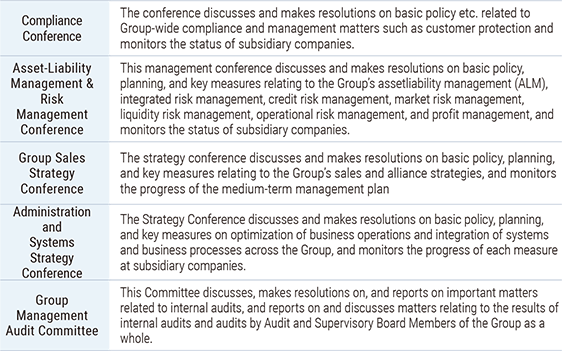

Management Committee

The Management Committee, which consists of representative directors, directors, and others, was established under the Board of Directors.

Based on the basic policy and management plans decided by the Board of Directors, the Management Committee discusses and decides on important business execution matters and strategies for flexible business execution within the Group, and also holds preliminary discussions on resolutions of the Board of Directors as necessary.

In addition, for important matters related to the Group’s business execution, the meetings listed on the right are positioned as part of the Manage-ment Committee, and these meetings conduct intensive deliberation on items within their respective jurisdictions.

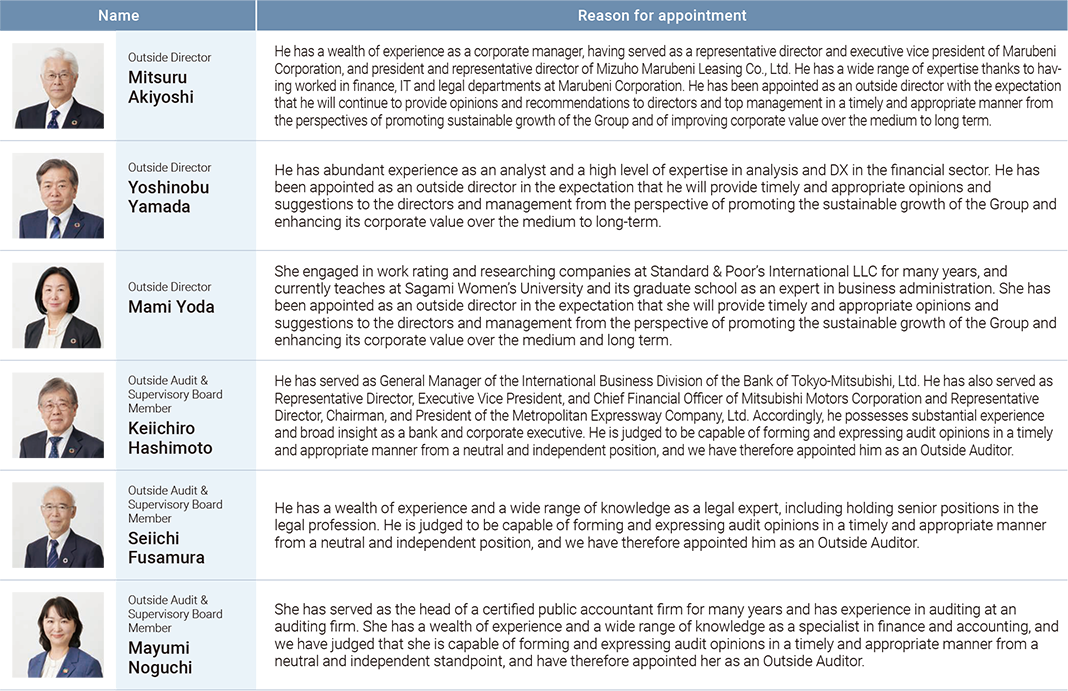

Considerations for the Appointment of Directors and Audit & Supervisory Board Members

Directors

Candidates for Director are appointed by the Board of Directors after any deliberation by the Compensation and Personnel Committee, based on factors such as views on the composition of the Board of Directors. Persons satisfying the following items are appointed from among candidates for outside directors.

- A.Persons who meet the Company’s criteria for independence and who have no risk of a conflict of interest with general shareholders

- B.Persons with extensive experience and extensive knowledge in the fields of corporate management, fiscal affairs, finance, economics, accounting, taxation, legal affairs, etc.

- C.Persons who, based on their experience and expertise, can provide timely and appropriate views and proposals to directors and the management team from the perspective of promoting sustainable growth of the Group and raising medium-to long-term corporate value

Audit & Supervisory Board Member

After obtaining the consent of the Audit & Supervisory Board, candidates for Audit & Supervisory shall be appointed by the Board of Directors. Persons satisfying the following items are appointed from among candidates for outside Audit & Supervisory Board Members.

- A.Persons who meet the Company’s criteria for independence and who have no risk of a conflict of interest with general shareholders

- B.Persons with extensive experience and extensive knowl-edge in the fields of corporate management, fiscal affairs, finance, economics, accounting, taxation, legal affairs, etc.

- C.Persons who can be expected to contribute to securing sound and sustainable growth of the Group and to enhancing its corporate value over the medium to long term by forming and expressing audit opinions in a timely and appropriate manner based on their own experience and views, given that the appointment of such persons is mandatory in order to further strengthen the neutrality and independence of the audit system

Reasons for Appointment of Outside Officers

- *For details on reasons for the selection of the above personnel as directors and Audit & Supervisory Board members, and an overview of the independence criteria, refer to Reference Materials for the General Meeting of Shareholders in the Notice of the 5th Annual General Meeting of Shareholders, Notice of the 7th Annual General Meeting of Shareholders and Notice of the 8th Annual General Meeting of Shareholders posted on the Company website.

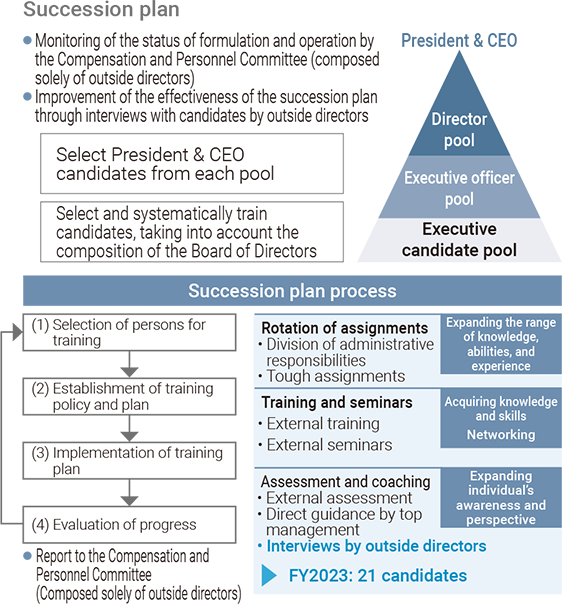

Succession Plan

In order to promote sustainable growth and enhance corporate value over the medium to long term, the Group has formulated a succession plan for the top management of the Company and its major subsidiar-ies, the Bank of Yokohama and the Higashi-Nippon Bank.

The succession plan is divided into three groups: the director pool, the executive officer pool, and the executive candidate pool, and candidates for President & CEO are selected from each pool. By implementing training programs tailored to the candidates’ capabilities, qualities, experience, etc., we are systematically cultivating human resources who will take on top management roles in the future. Specifically, we aim to broaden the scope of knowledge and skills of candidates through planned rotations of assignments, training and seminars, and to raise awareness among candidates through external assessments and interviews with outside directors and top management.

The status of the formulation and operation of the plan is regularly reported to the Compensation and Personnel Committee, which is composed solely of outside directors.

Outside directors not only receive reports, but also strive to improve the effectiveness of the Succession Plan by gaining a multifaceted understanding of the candidates through various meetings, interviews, and discussions,and by providing advice and recommendations to the candidates based on their extensive knowledge and experience.

Support for Directors and Audit & Supervisory Board Members

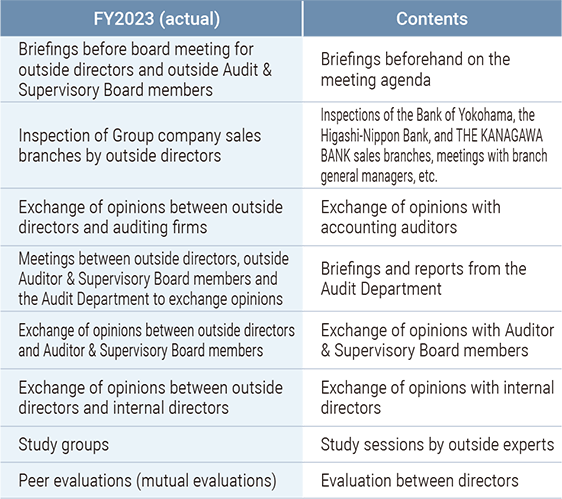

In order to enhance Board of Directors meetings, the Company provides outside directors and outside members of the Audit & Supervisory Board with advance explanations of the agenda of the Board of Directors meetings, as well as opportunities for on-site visits to sales branches of the Group companies.

When outside directors and outside members of the Audit & Supervisory Board are appointed, they are provided with the opportunity to acquire knowledge and information about the Group’s management philosophy, management policies, business plans, and business structure. Further-more, we work for coordination between the outside directors and the representative director, the Audit & Supervisory Board members, internal audit departments, and accounting auditors, as well as for interchange between the outside directors and the directors of the Group companies.

In order to ensure that directors obtain information about the company in a timely and appropriate manner, a staff member is assigned to the Corporate Planning Department to assist directors in obtaining information.

To ensure that audits are conducted effectively, we have a dedicated staff member in the Audit & Supervisory Office to support audits by the Audit & Supervisory board.

To enable directors and Audit & Supervisory Board Members to fulfill their roles and responsibilities, the Company provides opportunities to obtain knowledge and information, receive advice from external experts, and raise awareness through peer evaluations (mutual evaluations) by directors.

Discussions between outside directors and investors/analysts.

At our Investor Relations Day in February 2024, outside directors had an opportunity to meet with investors and analysts in order to directly hear and understand voices from the market.

Study sessions by outside experts

In order to enhance Board of Directors deliberations and improve governance, study sessions were held by outside experts, focusing on themes related to digital/IT, sustainability, and open innovation. In addition, we held study sessions on trends in new businesses of other companies in the industry with the aim of expanding our business areas utilizing strategic investments.

Visits to the Bank of Yokohama, the Higashi-Nippon Bank, and THE KANAGAWA BANK sales branches

In order to deepen their understanding of the subsidiary banks’ business operations and sales sites, outside directors inspected the Bank of Yokohama, the Higashi-Nippon Bank, and THE KANAGAWA BANK sales branches. At the sales branches, they observed business operations and held meetings and discussions with regional headquarters managers and branch general managers.

- The Bank of YokohamaHamagin Finance, Hamagin Research Institute

- The Higashi-Nippon BankFuchu Branch

- THE KANAGAWA BANKHead Office, Kofukuji Branch, Rokkakubashi Branch

Compensation and Personnel Committee

For the purpose of ensuring objectivity and transparency in compensation and personnel matters of directors and executive officers (hereinafter, "Officers"), a Compensation and Personnel Committee consisting solely of outside directors has been established as a voluntary mechanism. The Compensation and Personnel Committee performs the functions of both a nominating committee and a compensation committee.

Overview of the Compensation and Personnel Committee

Composition/Independence: Composed solely of outside directors selected by resolution of the Board of Directors (hereinafter referred to as "Committee Members"). In order to ensure the independence of the Compensation and Personnel Committee, all Committee Members must be independent outside directors. The Chairperson of this Committee shall be elected by the Committee Members from among themselves. In principle, the President shall provide explanations to the Committee, and if necessary, persons other than the Committee Members designated by the Chairperson may be allowed to attend the meeting and their reports or opinions to be heard.

Authority and Role: Discussion on compensation and personnel matters for directors of the Company and its subsidiaries. The Committee shall deliberate on and decide the following matters.

1 Compensation of the Company's Officers

(1)Details of the Company's compensation structure according to position

(2)Individual compensation amounts based on the Company's position-specific compensation table (excluding performance-linked compensation)

(3)Amount of compensation linked to the Company's performance

(4)Performance evaluation of the Company's executive directors and executive officers

(5)Evaluation of the achievement of performance targets for the Company's medium- and long-term incentive compensation

(6)Establishment, revision, or abolition of systems related to compensation for officers of the Company

(7)Other matters deemed necessary by the Chairperson

2 Compensation of officers of subsidiaries

(1)Details of subsidiaries' tables of compensation according to position

(2)Amount of compensation linked to the subsidiary's performance

(3)Evaluation of the achievement of performance targets for the subsidiary's medium- and long-term incentive compensation

(4)Establishment, revision, or abolition of systems related to the compensation for officers of subsidiaries

(5)Other matters deemed necessary by the Chairperson

3 Personnel matters regarding officers of the Company and its subsidiaries

(1)Appointment and dismissal of candidates for directors of the Company, and dismissal of directors, and selection and dismissal of executive directors, representative directors, and the President and Executive Officer of the Company

(2)Selection and dismissal of the president of a subsidiary

(3)Other matters deemed necessary by the Chairperson

Frequency of meetings: As necessary.

Secretariat: Office of the Secretary, Corporate Planning Department

Members of Compensation and Personnel Committee

| Name | Job title | Number of meetings attended/held in FY2023 (excluding written discussions) |

|---|---|---|

| Chair: Mitsuru Akiyoshi | Outside Director | 10/10 |

| Board Member: Yoshinobu Yamada | Outside Director | 10/10 |

| Board Member: Mami Yoda | Outside Director | 10/10 |

Major Deliberations for FY 2023

(Matters related to personnel)

- Group executive personnel

- Succession Plan Operation and Status

(Matters related to remuneration)

- Verification of the Executive Compensation Table by an external research organization based on executive compensation data

- Group and Subsidiary Bank Executive Compensation Table

- Review of the policy for determining executive compensation, etc*

- *

Review of the evaluation method for short-term performance-linked compensation

- In light of the business integration of the Company’s subsidiaries, The Bank of Yokohama, Ltd. and THE KANAGAWA BANK, LTD., we have revised our “core net business profit”, which is an indicator of the profitability of our core business and is one of the indicators used to evaluate the Company performance, from “the combined total for The Bank of Yokohama, Ltd. and The Higashi-Nippon Bank, Limited” to “the combined total for the Group’s banks”.

- In order to realize our long-term vision, we have removed “comparisons with competitors’ performance, etc.” from the evaluation of Company performance so that each officer can focus on achieving the targets they have set for themselves.

Executive Compensation System

1.Directors

The Company has adopted by resolution of the Board of Directors a policy (‘the Policy’) concerning decisions on the details of remunera-tion etc. for individual directors. The outline of the document is as follows. This policy was decided on after deliberation by the Compen-sation and Personnel Committee, which is comprised solely of outside directors.

(1)Basic policy

- The compensation system for directors is to function as an appropriate incentive to promote the sustainable growth of the Group and increase its corporate value over the medium to long term, while minimizing excessive risk-taking.

- Compensation composition, compensation composition proportions, and compensation levels are determined through periodic comparisons and verification based on data on executive compensation from external research organizations and objective survey data, using as benchmarks a group of companies with performance and business conditions similar to those of the Company.

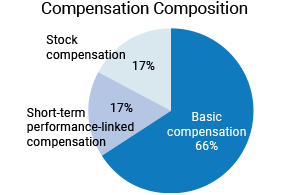

(2)Compensation Composition and Details

Directors (excluding non-executive directors and outside directors)

- A. Compensation composition

-

- Compensation consists of base compensation (fixed), short-term-performance-linked compensation (performance-linked), and stock compensation (Trust I: not performance-linked, Trust II: performance-linked).

- The amount of basic compensation, short-term-performance-linked compensation and stock compensation is determined by position. The composition of the different compensation items is 66% for basic compensation, 17% for short-term performance-linked compensation and 17% for stock compensation (when short-term performance-linked compensation and stock compensation are paid in standard amounts).

- B. Details of each compensation item

-

- (a)

Basic compensation

- Basic compensation is paid monthly based on role and responsibilities.

- (b)

Short-term performance-linked compensation

- Short-term-performance-linked compensation is an annual payment based on the Company's performance and on the evaluation according to the individual business performance of each officer for the fiscal year.

- The indicators used to evaluate company performance are “core net business profit (the total for the Group's banks)”, which indicates the profitability of the core business, and “profit attributable to owners of parent”, which is the final operating result. The base amount for each position is determined in accordance with the evaluation of company performance. The base amount for each position ranges from 0% to 150% of the standard amount for the position.

- Personal performance is evaluated based on the degree of achievement of targets set at the beginning of each fiscal year. (Roughly five items are set for each person based on the department in charge, such as achievement of budget, development of each measure, and establishment of the risk management system.) The amount of pay for each position varies from 70% to 130% of the standard amount for the position, in accordance with the evaluation of the individual. Note that the final evaluation of the performance of the Company and of individual officers is subject to deliberation by the Compensation and Personnel Committee.

- (c)

Stock compensation

- “Stock compensation” is a program in which Company shares and an amount equivalent to the cash proceeds from the conversion of the Company's shares (hereinafter, “Company shares etc.”) are issued and paid (hereinafter, “issued etc.”) to the trust.). Two types of trusts (Trust I and Trust II) have been established as follows.

- In the event of a serious violation of the contract of appointment between the Company and an officer with respect to the officer's duties, or in the event of a sudden deterioration in business performance or a serious incident or scandal that damages corporate value, the Company may require that the officer forfeits stock delivery points (malus), returns the granted Company stock (clawback), or provides compensation.

- 1)

Trust I

- Company shares etc. equivalent to the standard amount for each position are accumulated monthly and deferred until the retirement of each officer.

- 2)

Trust II

- Company shares etc. equivalent to the standard amount for each position are accumulated monthly and deferred until the end of the medium-term management plan and Company shares etc. equivalent to the amount reflecting the performancelinked coefficient are issued etc.

- The performance-linked coefficient fluctuates within the range between 75% and 200% depending on the degree of achievement of performance targets in the medium-term management plan. In order to increase incentives to achieve the goals of the medium-term management plan, the following three target indicators in the medium-term management plan (FY2022- FY2024) are the financial indicators used to determine the performance-linked coefficient. The final performance-linked coefficient is calculated by adding an adjustment range for non-financial indicators (within the range of -15% to +30%) to the performance-linked coefficient based on financial indicators, and is determined through deliberation by the Compensation and Personnel Committee. However, the final performance-linked coefficient to be determined shall not exceed a maximum of 200% or a minimum of 75%.

- Financial Indicators

-

- ROE (consolidated basis, based on shareholders' equity (average of beginning and ending balances))

- OHR (consolidated basis)

- Common Equity Tier 1 capital ratio (consolidated basis, Basel III finalized, fully implemented basis (excluding valuation difference on available-for-sale securities))

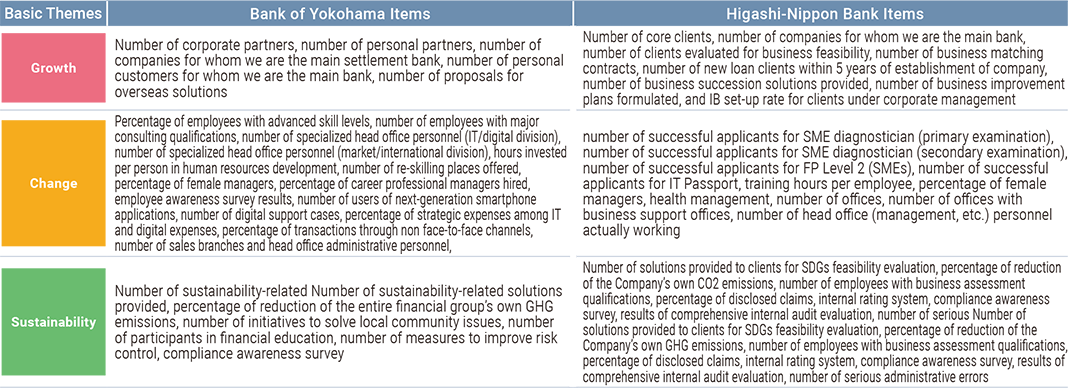

- Ratings by ESG rating agencies

-

- Assessment Index

- FTSE Overall ESG Score, MSCI ESG Ratings

- Non-financial items in the medium-term management plan

(Medium-term Management Plan for FY2022 to FY2024)

- (a)

Non-Executive Directors/Outside Directors

- A. Compensation composition

-

- In view of the role in supervising execution of business, their compensation is not linked to performance, but is only basic (fixed) compensation.

- B. Compensation details

-

- Basic compensation is paid monthly based on role and responsibilities.

2. Audit & Supervisory Board Member

The details of compensation etc. for Audit & Supervisory Board members are determined through discussions with them.

- A. Compensation composition

- To ensure neutrality and independence of Audit & Supervisory Board members, compensation is not linked to performance, but is only basic (fixed) compensation.

- B. Compensation details

- Basic compensation is paid monthly based on role and responsibilities.