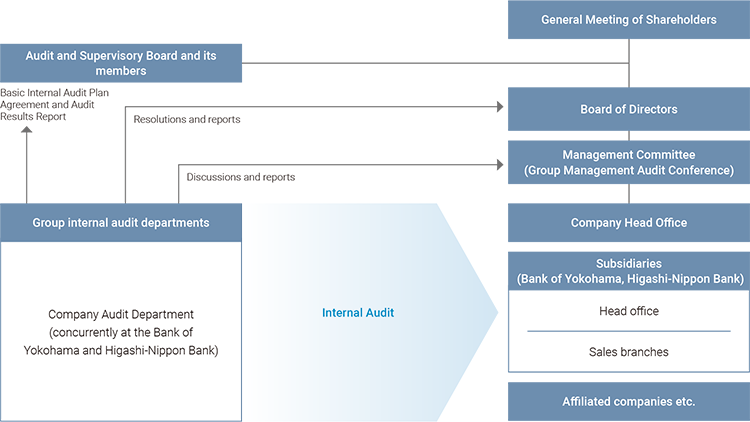

Internal Audit System

Role of Internal Auditing

The Internal Audit Department (the Group’s internal audit department), verifies and evaluates the appropriateness and effectiveness of internal management systems and internal controls, including compliance and risk management, from a standpoint independent of the executive divisions, with the aim of ensuring the sound and appropriate operation of business and contributing to the achievement of management goals, and makes recommendations for correcting and improving issue points.

Group Internal Audit System

In order to ensure that internal audits can be conducted using uniform methods and standards within the Company, the Company and its subsidiaries have established the “Basic Rules for Internal Audits” to be followed when establishing policies and rules.The members of the Internal Audit Department of the Company are generally assigned concurrently to the Internal Audit Departments of the Bank of Yokohama and Higashi-Nippon Bank. This establishes a system for efficient and effective internal audits on a group-wide basis and conducts consistent internal audits, thus strengthening the internal audit function.The Company’s Internal Audit Department establishes a mid-term basic internal audit plan and conducts internal audits of each department and consolidated subsidiary based on the basic internal audit plan formulated each fiscal year, and reports the results and the status of the executive department responses to issues to the Group Management Audit Conference, the Board of Directors, and the Audit and Supervisory Board (*1) once every three months.In order to conduct more effective internal audits, we collaborate with auditors, accounting auditors, and departments in charge of internal control functions by periodically exchanging information.

- (*1)The Company transitioned to a Company with an Audit and Supervisory Committee in June 2025. The Company's Internal Audit Department regularly reports the results of internal audits and the status of the executive department responses to issues to the Audit and Supervisory Committee.

Efforts to Improve Internal Audit Performance and Efficiency

In order to be forward looking in preventing the emergence of risks, which fluctuate due to changes in the internal and external environment and in order to effectively and efficiently allocate limited audit resources to audit targets, our Internal Audit Department conducts risk-based audits by assessing risks inherent in departments and operations subject to internal audits (risk assessment) and by determining audit targets, frequency, and depth according to the results. For audit areas requiring advanced expertise, we are cooperating with external institutions as needed to enhance our audit framework.Furthermore, in order to maintain and improve the quality of audits, we are promoting the securing of diverse experts (*2) and developing training plans for audit staff. In FY2024, we introduced the Continuing Professional Education (CPE) program, which provides 20 hours of continuous professional education per year, as part of our efforts to develop human resources on a planned basis and to strengthen our auditing infrastructure. (As of March 31, 2025, 52 employees (of which, 36 are men, 16 are women, and 8 are mid-career hires) belonged to this program.)

- (*2)Ten (10) certified internal auditors, seven (7) certified public accountants, one (1) information systems auditor, three (3) securities analyst and others

Vision and KPIs of the Internal Audit Department

The Company's Internal Audit Department has adopted the vision of “supporting the achievement of management goals” set by the Board of Directors. In order to realize this vision, the Company has formulated a roadmap for enhancing the internal audit system and strengthening the auditing foundation, and regularly reports the status of progress to the Group Management Audit Conference, the Board of Directors, and the Audit & Supervisory Board (*3). In addition, we have set KPIs for achieving the vision (including an increase in the percentage of qualified auditors and an increase in the number of audit-focused (*4) man-hours on specific themes) and are working to achieve the vision set by the Board of Directors.

- (*3)The Company transitioned to a Company with an Audit and Supervisory Committee in June 2025.

- (*4)In FY2024, we conducted audits focusing on themes such as the status of credit risk management, the appropriateness of the cybersecurity management system, and the status of sustainability initiatives.