Policy Shareholding

Policy of Policy Shareholdings

The "Policy of Policy Shareholdings" for listed shares of the Company and Group banks is as follows.

The basic policy is to reduce the balance for the sake of minimizing financial risk due to stock price fluctuations and of using capital efficiently with an awareness of the capital cost.

- (*1) "Group banks" refers to the Bank of Yokohama, Higashi-Nippon Bank and THE KANAGAWA BANK.

- (*2)

Policy shareholdings are classified by purpose into (1) shares for business purposes and (2) shares for business strategy purposes. (1) accounts for the majority.

Shares for business purposes are shares of companies that play a central role in the local economy, companies that contribute to regional growth through regional development, companies in need of regeneration support, companies that offer a risk-return profile commensurate with their capital cost, etc.- (1)Shares for business purposes are shares of companies that play a central role in the local economy, companies that contribute to regional growth through regional development, companies in need of regeneration support, companies that offer a risk-return profile commensurate with their capital cost, etc.

- (2)Shares for business strategy purposes are shares of companies that are expected to have strategic business effects through business alliances and other means.

- (1)

We periodically review the significance, economic rationale, etc. of our shareholdings and if holdings are deemed inappropriate, we sell them, taking into consideration circumstances that should be taken into account, such as negotiations to improve profitability and market impact.

Even when shareholdings are deemed appropriate, we may sell them in accordance with our basic policy of reducing outstanding balances, taking into consideration the market environment, management, and financial strategies, etc.

Furthermore, when policy-holding shareholders indicate an intention to sell the Company's shares, the Company will take no actions to prevent such sales.

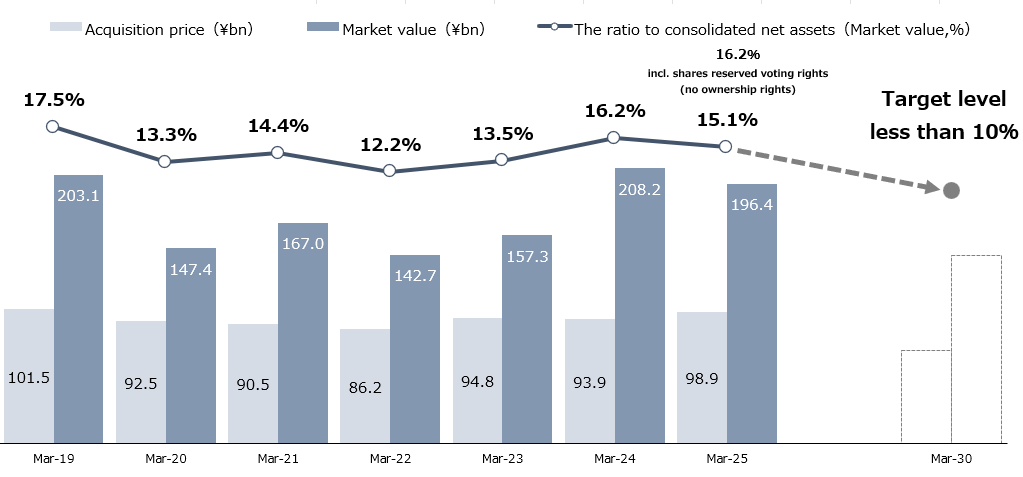

Initiatives to Reduce Policy shareholdings

In FY2024, the group banks collectively sold policy shareholding listed stocks with an acquisition price of 2.3 billion yen and a market value of 7.7 billion yen.

Starting from FY2025, we have revised our target to reduce the ratio of the market value of shareholdings, including the total of listed and unlisted stocks excluding shares with reserved voting rights (no ownership rights), held by The Bank of Yokohama, Higashi-Nippon Bank, and The Kanagawa Bank to less than 10% of consolidated net assets by the end of March 2030. We will further accelerate our efforts to reduce policy shareholdings more than ever before.

Additionally, We will not reclassify policy shareholdings into pure investment shares.

( Trend in Balance of Policy shareholdings , The ratio to consolidated net assets)

- (*1)The total of listed and unlisted stocks (excl. shares reserved voting rights) held by The Bank of Yokohama, Higashi-Nippon Bank, and The Kanagawa Bank.

- (*2)"Shares reserved voting rights (No ownership rights)" refers to shares that are not owned but for which the authority to exercise voting rights or the authority to give instructions concerning such is reserved under a trust agreement, etc. In the case of our Group, this applies to investment shares contributed as trust assets for the purpose of providing lump-sum retirement benefits.

- (*3)Due to return of a portion of shares reserved voting rights to the bank account, the policy shareholdings (at acquisition price) increased as of the end of March 2023 and the end of March 2025. As of the end of March 2025, the shares reserved voting rights was 17.9 billion yen at acquisition price and 13.8 billion yen at market value.

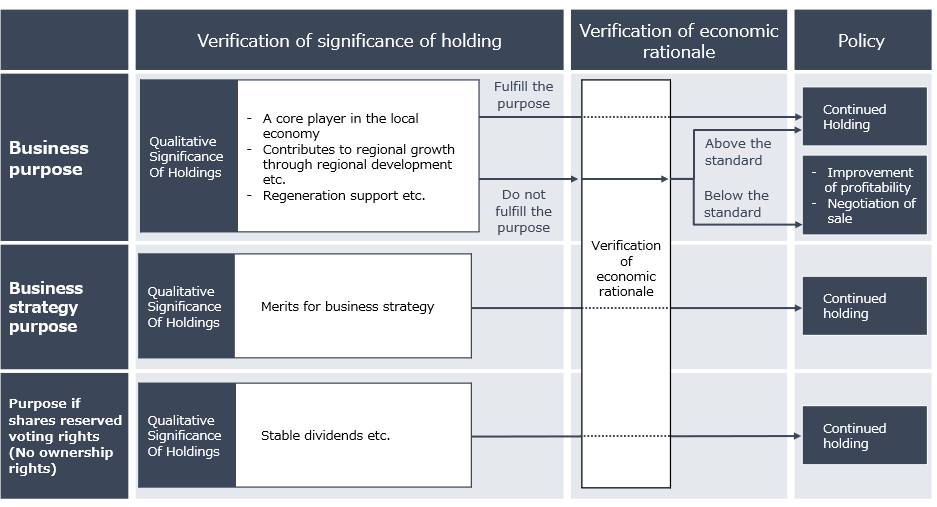

Evaluation of the significance of holdings and the economic rationale

The Company’s Board of Directors regularly verifies each company whose listed shares are held by the Company as policy shareholdings for the significance of holdings (its contributions to regional development, strengthening of long-term and stable business relationships, etc.) and the economic rationale (risk-return commensurate with cost of capital).

In order to verify the economic rationale, we set standard values for return on risk-weighted assets (RORA) and for return on capital employed (risk quantity base) according to the ROE target.

In addition, the Company periodically checks the progress of efforts for sale negotiations and profitability improvement.

<Flowchart for verifying the significance of policy shareholdings and Shares reserved voting rights (No ownership rights) and economic rationale (image)>

- (*1)RORA = Profit after costs /Risk assets; Return on capital employed = Profit after costs /Amount at risk

Profit after costs: Excludes credit costs, expenses, etc. associated with equity holdings and credit. Includes stock dividends and excludes gains (losses) on sales and unrealized gains (losses).

Amount of risk of risk assets: Sum of credit and market risk - (*2)The qualitative significance of holding is checked, and even if shares are to continue to be held, the economic rationale is verified, and efforts are made to improve profitability from the point of view of effective use of capital. We may sell shares taking into consideration the market environment, management and financial strategy, etc.

- (*3)For stocks whose profitability is not expected to improve for a certain period of time, sale is negotiated.

- (*4)Business purpose includes the portion available for sale.

Voting Rights Exercise Standards

When exercising voting rights, the Group decides whether to approve or reject proposals in a comprehensive manner, after confirming such factors as the management policies (regarding increase of corporate value over the medium to long term and sustainable growth), governance, and business details of the company whose shares are cross-held, and considering the matter from the viewpoint of share value.

In cases when there are important proposals that may cause significant fluctuations in share value or when the details of the proposal are unclear, the Company carefully decides whether to approve or reject the proposal by such means as separately engaging in dialogue with the company whose shares are cross-held as necessary. Proposals that the Group considers important are as follows.

・ Surplus appropriation proposals (in cases of large-scale losses, etc.)

・ Proposals on the election of Directors and Audit & Supervisory Board Members (cases of impropriety or losses occurring over a certain continuous period)

・ Proposals on anti-takeover measures

・ Proposals on organizational restructuring

・ Proposals on payment of retirement benefits (for Audit & Supervisory Board Members, etc.)

Status of Shares(As of March 31, 2025)

Our primary business is managing the operations of our subsidiaries. The shares we hold are limited to affiliate company shares, and we do not hold any investment shares.

The status of investment shares (policy shareholdings) held for purposes other than pure investment by The Bank of Yokohama, Ltd., with the largest investment share balance in our company and subsidiaries, is as follows. Additionally, The Bank of Yokohama, Ltd. does not hold any investment shares for the purpose of pure investment.

No. of issues and Total B/S Amount

Issues with increased shares in FY2024

(*) Excluding shares that have undergone changes due to share splits, share transfers, share exchanges, or mergers, etc.

Issues with decreased shares in FY2024

(*) Excluding shares that have undergone changes due to share consolidation, share transfers, share exchanges, or mergers, etc.

For more information on details of the policy shareholdings, please see the list below.