Contributing to the Growth of Local Economies

Policy on Initiatives

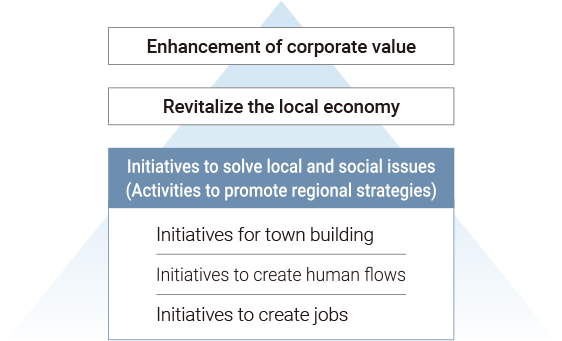

As a regional financial institution, the Group hopes to achieve a “sustainable virtuous circle” in which we also grow by proactively working to resolve regional and social issues and contributing to making the region attracive and the revitalization of local economies.

Based on these policies, we support the implementation of measures to realize the regional vision of the government and are moving forward with initiatives (regional strategy promotion activities) to solve regional and social issues such as “creating towns”, “creating flows of people”, and “creating jobs”. We are fulfilling our role as a regional hub, expanding the scope of industry-academia-government-finance collaboration, and strengthening our efforts to revitalize local communities and solve their problems.

Our visualization study of the social effects expected to be brought about by regional strategy promotion activities continues.

Regional Strategy Promotion Systems

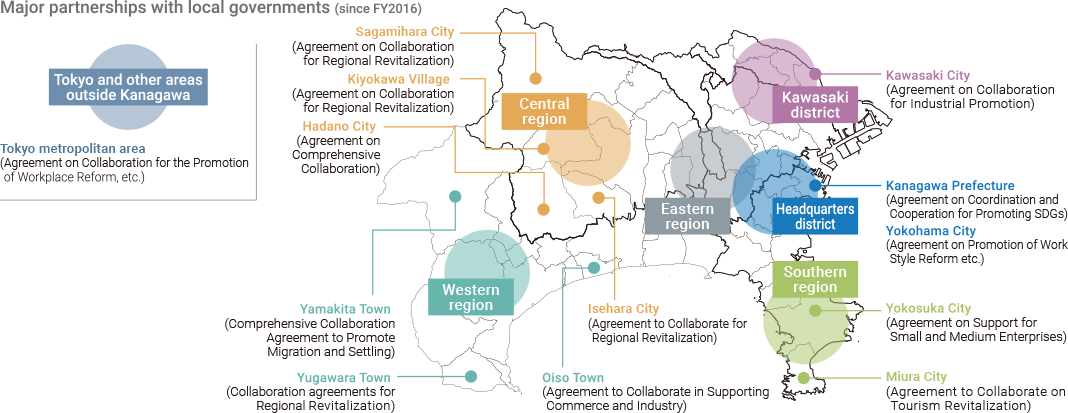

In its head office, the Bank of Yokohama has a Regional Strategic Planning Department that is responsible for formulating visions for regions and plans to achieve them, and a regional head office structure that organizes our business area into three areas (headquarters, Kawasaki and Tokyo, and outlying areas), and four regions (eastern, western, southern, and central) to raise the effectiveness of regional strategy promotion activities.

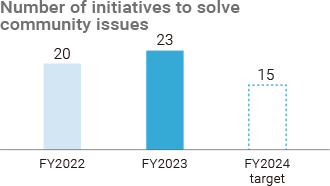

Based on this policy, under the regional strategy promotion system, the Bank of Yokohama is working to revitalize local communities and address issues. As a result, we achieved our single fiscal year targets, with 20 projects in FY2022 and 23 projects in FY2023, exceeding the medium-term management plan target of 15 projects for initiatives to solve local community issues.

Initiatives for sustainable “town building”

Support for the opening of the Sagamihara Biogas Power - Tana Power Plant

The Bank of Yokohama used the SDGs Green Loan to provide financial support for the opening of the Sagamihara Biogas Power - Tana Power Plant.

This power plant uses food waste to create biogas through methane fermentation for power generation. The plant works with a nearby Group company to take in local food waste and turn it into feed, fertilizer, and energy. It is Japan’s first cascade recycling facility.

Public-private partnerships through the Regional Decarbonization Platform

The Bank of Yokohama established the Regional Decarbonization Platform for local governments in Kanagawa Prefecture in May 2022 in order to contribute to the promotion of regional decarbonization. Through this platform, issues commonly faced by public entities in each region were identified, and subcommittees were set up for each issue to study them and discuss how to formulate projects. In May 2023, the “EV Car Shar e Project” was launched as an actual project.

EV Car Share Project

The Bank of Yokohama concluded partnership agreements with Isehara City, ENEOS Corporation, and Hamagin Finance, and started the development of an EV car sharing business through a public-private partnership in November 2023. The Bank of Yokohama and Isehara City use EV vehicles on weekdays and offer them to locals and tourists for a fee on weekends. These vehicles will be used as “movable storage batteries” at evacuation centers and other places in times of disaster.

(Partners: Isehara City, ENEOS Corporation, Hamagin Finance)

Environmental Education Project

The participation of local residents is essential to achieving a decarbonized society. In this project, we focused on children with high environmental awareness and developed an investigation-based learning program in which children themselves engage in problem-solving. The topic will be sustainable aviation fuel (SAF), produced by utilizing waste cooking oil from households and other sources, and the learning program will be implemented through public-private partnerships.

(In cooperation with:Yokohama Nishimae Elementary School, Saffaire Sky Energy, Revo International, Inc. and the Yokohama Junior Chamber International)

Participation in Yokohama City’s PPP Platform

The Bank of Yokohama participated as the operating secretariat in the Yokohama PPP Platform (Yopp), which was established by the City of Yokohama to promote participation in PPP/PFI projects by companies in the city and to work with a variety of private sector companies on PPP/PFI projects. The Bank held the first seminar in November 2022 and the first PPP study session in January 2023. We will support activities on this platform through financial cooperation, matching companies with each other, etc. to solve local issues and to create local attractions, thereby contributing to the sustainable growth and revitalization of the local economy.

Initiatives to “create human flows” to regions

Project using local resources to revitalize tourism in Miura City

In March 2021, the Bank of Yokohama, Miura Trust Co., Miura City, the Regional Economy Vitalization Corporation of Japan (REVIC), and Keikyu Corporation signed a partnership agreement that will use local resources to revitalize tourism in Miura City. The project promotes the revitalization of tourism in the area around Misaki Port.

Under this partnership agreement, the Bank of Yokohama supported Miura Trust with business operations and financial backing, helping to launch dispersed hotels, including “misakijyuku edonokurayado”. In September 2023, “misakijyuku hayama shoten” opened, bringing the total to five buildings in operation.

We aim to utilize tourism resources through linking with activities offered in the area with a view to encouraging longer stays by tourists and increasing overnight guests in Miura City.

Joining public-private partnership consortium for child-rearing support

In November 2023, the Bank of Yokohama joined the public-private partnership consortium Kodomo no Mirai Kyoso Platform (“Children’s Future Co-creation Platform”), led by a venture company in Yokohama. The Bank helped test a shared taxi shuttle service exclusively for children.

This platform was set up to help families with children re-enter working life or start new jobs. It does this by easing the burden of shuttling kids to and from after-school activities. In the trial, we supported implementation by showing “Hamagin Money Classroom”, our branded financial literacy education program, on monitors inside taxis and by setting up stops in front of our branches.

Participation in ‘Kanagawa Pay’, Kanagawa Prefecture’s ashless consumption stimulation project

The Bank of Yokohama implemented “Kanagawa Pay,” a cashless consumption stimulus project that it is working on together with Kanagawa Prefecture. (First phase: October 2021, Second phase: July 2022, Third phase: July 2023) This project is an initiative to reward consumers with points equivalent to up to 20% of the amount of QR code payments made through “Kanagawa Pay” when paying at participating merchants in the prefecture. The Bank of Yokohama, as a representative organization of the joint venture, was entrusted by Kanagawa Prefecture with the management of this project and promoted cashless payments as a payment provider that offers the HamaPay smartphone payment service.

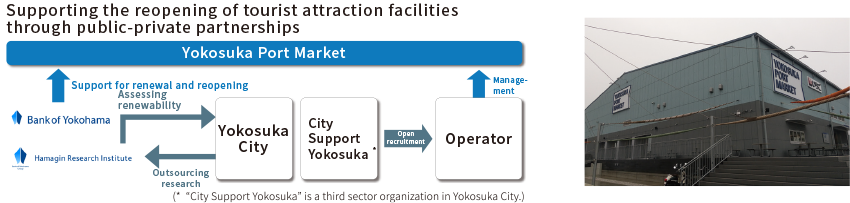

Support for achieving the reopening of the Yokosuka Port Market

The Bank of Yokohama Group supported the renewal of the Yokosuka Port Market (Port Market). Port Market features restaurants and souvenir stores selling local fresh foods under the concept of “Miura Peninsula Food Experience” of enjoying food from Miura Peninsula. Launched in 2013 as part of Yokosuka City’s local production for local consumption promotion project, Port Market closed in 2019 due to poor performance.

Subsequently, the Bank of Yokohama Group investigated the site that Hamagin Research Institute was considering for renewal and evaluated it as an area with potential to be revitalized as a tourist attraction facility, and the Bank of Yokohama worked to assist in attracting tenants. As a result, Port Market reopened in October 2022, helping to revitalize tourism.

Revitalization of tourism in Miyagase district

The Bank of Yokohama signed a “Collaboration Agreement on Community Revitalization” with Kiyokawa Village in November 2019 and an “Agreement on Collaboration and Cooperation for Sustainable Community Revitalization” with Coen Co., Ltd. in November 2021, and has been attracting business partners in the restaurant industry and planning and implementing events such as the Money Classroom. In October 2022, in cooperation with Sunautus Corporation, we supported the introduction of an electric scooter rental business at the Coen Miyagase store to revitalize tourism.

Initiatives to “create jobs” in the region

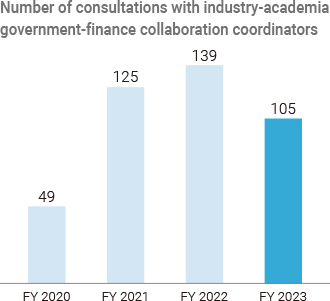

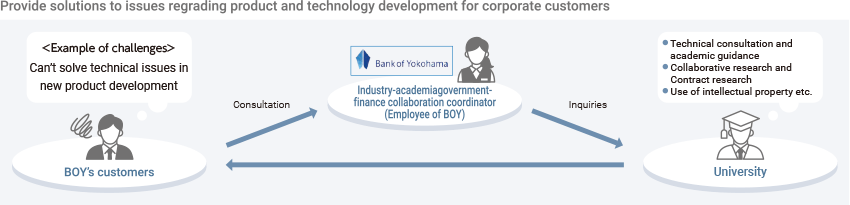

Support for commercialization through industry-academia-governmentfinance collaboration

The Bank of Yokohama is committed to solving local community issues by strengthening collaboration between industry, academia, government, and finance.

Yokohama National University, a national university with which we have concluded a comprehensive collaboration agreement, has appointed Bank of Yokohama employees as “Yokohama National University Industry-Academia-GovernmentFinance Collaboration Coordinators” to serve as a bridge between the university, which conducts research that contributes to solving problems, and corporate customers, who have technical problems to solve. In July 2022, the Bank of Yokohama concluded a comprehensive partnership agreement with Aoyama Gakuin University to accelerate sustainable growth and revitalization of the local economy through industry academiagovernment-finance collaboration. In October of the same year, Bank of Yokohama employees were appointed by Aoyama Gakuin University as “Aoyama Gakuin University Industry-Academia-Government-Finance Collaboration Coordinators”.

Furthermore, in February 2023, we held the “Tokyo Institute of Technology-Bank of Yokohama Collaboration New Technology Matching Meeting” with the Tokyo Institute of Technology. Through these efforts, we are uncovering projects that link industry, academia, government, and finance.

Supporting venture businesses through grants

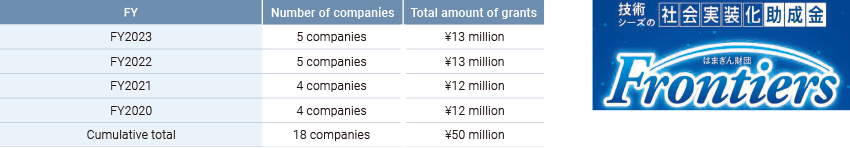

The Group gives grants to support venture businesses. The Bank of Yokohama of the Group, together with the Hamagin Industrial and Cultural Promotion Foundation, operates “Frontiers”, a program that promotes the commercialization of seed businesses held by venture companies and researchers. In FY2023, as in FY2022, we donated a total of ¥13 million to 5 companies.

Support for expansion of sales channels for local companies

Since October 2021, the Bank of Yokohama operates “Kanacolle”, a new e-commerce site that supports local companies’ efforts to develop products and expand sales channels through the “New Product Development Support Project Silent Partnership,” which both TV Tokyo Communications Corporation (TXCOM) and Yokohama Shinko Co., Ltd., have invested in since October 2021. On “Kanacolle”, newly developed bags, shoes, cushions, sweets, coffee, etc. from local companies are sold as original products in collaboration with TXCOM’s characters, programs, and other intellectual property (IP).