Forming a Digital Society

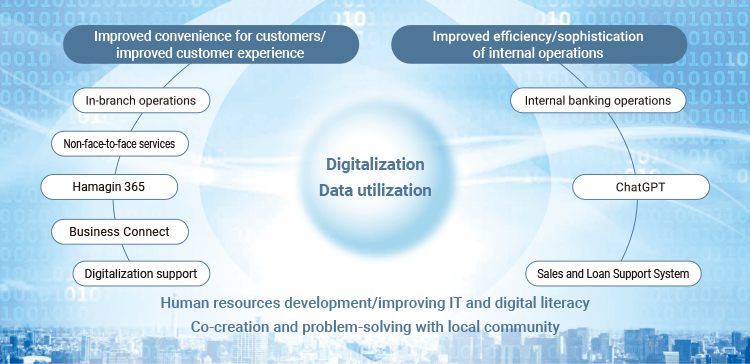

For our vision of being “a solution company rooted in communities and selected as a partner to walk together”, we will contribute to the sustainable development of local communities by delivering new experiences and value to local customers through financial and non-financial services using digital technology, and by supporting business growth by providing advanced digital solutions.

Digital Strategy

In the rapidly advancing digital society, all kinds of information is converted into data and connected, and people enjoy various conveniences by utilizing this data.

The Group will make the best use of this digital society and provide optimal proposals based on one-to-one communication with customers. In addition, we will create new customer experiences by improving customer convenience through the advancement of solution services and the promotion of cashless payments, will support digitalization, and will continue to develop human resources to provide these services.

Promotion Status of Digital Transformation

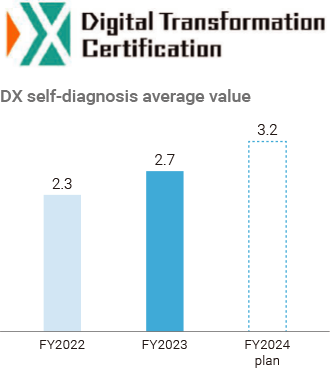

The Company and the Bank of Yokohama were certified as “DX Certified Business Operators” by the Ministry of Economy, Trade and Industry in July 2022 as businesses that are ready to promote digital transformation.

The Company will formulate a group-wide digital strategy, as well as monitor and control subsidiaries that implement the various policies. In addition, our subsidiaries, the Bank of Yokohama and Higashi-Nippon Bank, are working to improve customer convenience and enhance communication through digital, non-face-to-face means. As a result of these efforts, the Group’s DX Promotion Index has steadily improved to 2.7.*

- *We perform self-diagnosis at our Company using the “DX Promotion Metrics Self-Diagnosis Format” distributed by the Information-technology Promotion Agency, Japan (IPA).

Initiatives by the Bank of Yokohama

| Individual customers |

|

|

|---|---|---|

| Corporate customers |

|

|

Initiatives by Higashi-Nippon Bank

Our Corporate Portal (Business Connect) was introduced in December 2022. In addition, we are also promoting the use of RPA to improve operational efficiency within the bank and are promoting internet banking (IB) to our customers.

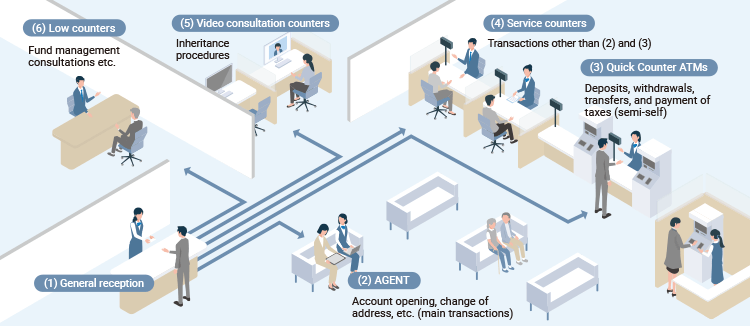

Digital transformation of branch operations

Transition to next-generation branches

As of March 31, 2024, the Bank of Yokohama has installed “Semi-self-service Counters” at 77 branches, where customers can use “Quick Counter ATMs” to make deposits or withdrawals using their cash cards with the support of Yokohama Bank staff. In order to further improve the efficiency of operations at branches and to increase convenience for customers, we will continue to move forward with the introduction of this teller window, as well as the transition to next-generation branches, including the establishment of TV teller windows and the upgrading of the “AGENT” next-generation sales branch tablet terminal.

With “AGENT” we have completed development for major transactions (account opening, change of address, inheritance acceptance,etc.) and are now undertaking in-house development, focusing on functional improvements and operations with high transaction volume. In October 2023, we implemented the new issuance function of IC cash cards for ordinary deposit accounts.

In addition, inheritance procedures via video consultation, which began at five branches in February 2023, was expanded by a further five branches in October 2023, bringing the total to 10 branches. We are gradually expanding the operations and working to provide detailed services through the specialist departments at head office.

Introduction of Branch Visit Reservation Service

In April 2023, the Bank of Yokohama introduced the “Visit Reservation Service” to all its branches. This service allows customers to reserve a date and time to come in for transactions such as opening an ordinary deposit account, changing personal information and registered seal details, etc. In principle, customers can make such reservations 24 hours a day, 365 days a year, via the Bank of Yokohama website using a smartphone or computer. Customers with reservations are given priority when they visit the branch. Through the introduction of this service, the Bank of Yokohama aims to reduce waiting times when customers visit its branches.

Expansion of non-face-to-face transactions

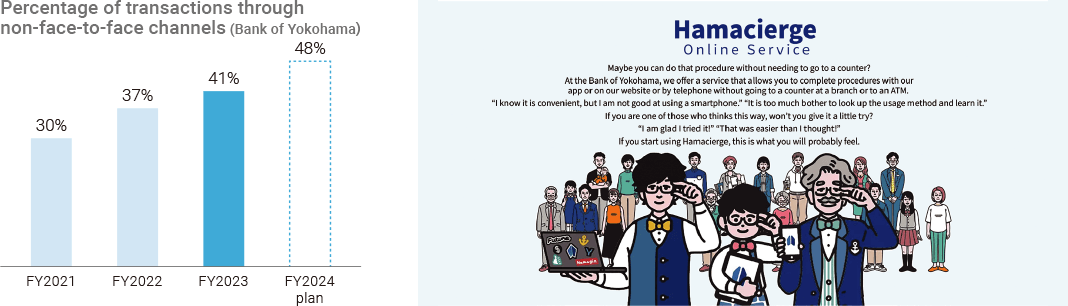

The Bank of Yokohama has been expanding non-face-to-face transactions focusing on change of address, payment of taxes and various fees, transfers, and account openings. Starting from March 2024, procedures for notification of inheritance have become available through the website. The percentage of non-face-to-face transactions has increased to 41% as of March 31, 2024. We will continue to expand non-face-to-face transactions to enhance customer convenience.

Digital transformation of non-face-to-face services

Providing the smartphone app “Hamagin 365”

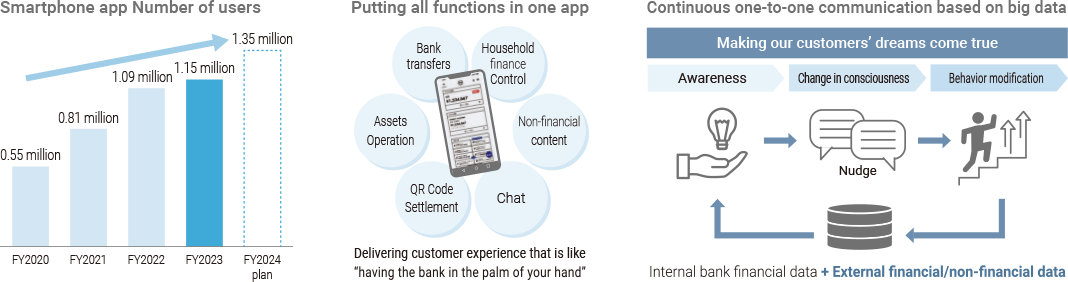

As contact with customers is shifting from face-to-face to non-face-to-face, the smartphone app “Hamagin 365” for personal customers has grown to become the most important channel, and as of March 31, 2024, it is used by 1.15 million Bank of Yokohama customers.

In October 2023, we added a color customization function to respond to customers’ preferences, and in November 2023 began bundling all the functions into a single app. As part of this, we added new functions, namely application to open new ordinary deposit account and simultaneous application for Yokohama Bank Card.

In April 2024, we received the award in the finance division of the ‘Top Publisher Awards 2024’ from data.ai. The Top Publisher Awards 2024 were conferred on companies that data.ai recognized as achieving substantial growth in the app market. We received the award because the number of downloads and users had soared in the year since ‘Hamagin 365’ was launched.

With Hamagin 365, we will expand non-face-to-face transactions by making all functions available in a single app. At the same time, we will pursue one-to-one communication with customers and add functions that meet the variable customers’ needs, and thereby create new experiences for customers.

Providing “Business Connect” non-face-to-face functionality to corporate customers

Since January 2020, the Bank of Yokohama has been offering Hamagin Business Connect, a membership portal site for corporate customers, as a non-face-to-face service aimed at improving customer convenience, and as of the end of March 31, 2024, we have 47,000 corporate customers using the site.

From November 2022, with the aim of enhancing digital communication with customers, we integrated the login screen for Hamagin Business Support Direct, our Internet banking service, into Hamagin Business Connect and offer a new Free Monthly Plan. The Free Monthly Plan allows one user to use the fund deposit transfer service and inter-account transfer service, which provide immediate transfers (up to ¥3 million per day) and pay taxes and various fees, free from any basic monthly charge.

In addition, in December 2023, we launched the “Zaimon” service for receiving e-Tax declaration data, with the aim of reducing the administrative burden of submitting financial statements in paper format. With Zaimon, customers who need to submit documents to the Bank of Yokohama when, for example, seeking a loan, can send tax declaration data and electronic certificates of tax payment in electronic format using the government’s e-Tax service to the Bank.

The Higashi-Nippon Bank also began offering Higashi-Nippon Business Connect from December 2022.

Promote cashless access in the community

Through its smartphone payment service HamaPay, the Bank of Yokohama joined a new payment infrastructure for high-frequency small-lot payments Cotra Money Transfer from October 2022, and started offering the Cotra Money Transfer Service, a fee-free service for remittances of ¥100,000 or less to personal accounts.

In addition, starting in April 2023, HamaPay began handling Cotra Pay Tax, which allows payment of property tax, automobile tax, and other taxes in “Pay Bills”.

Digital Transformation with Customers and Local Communities

Digitalization support

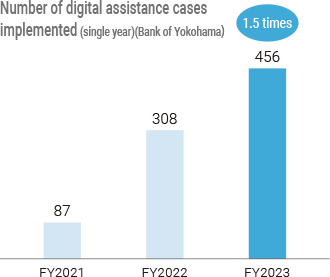

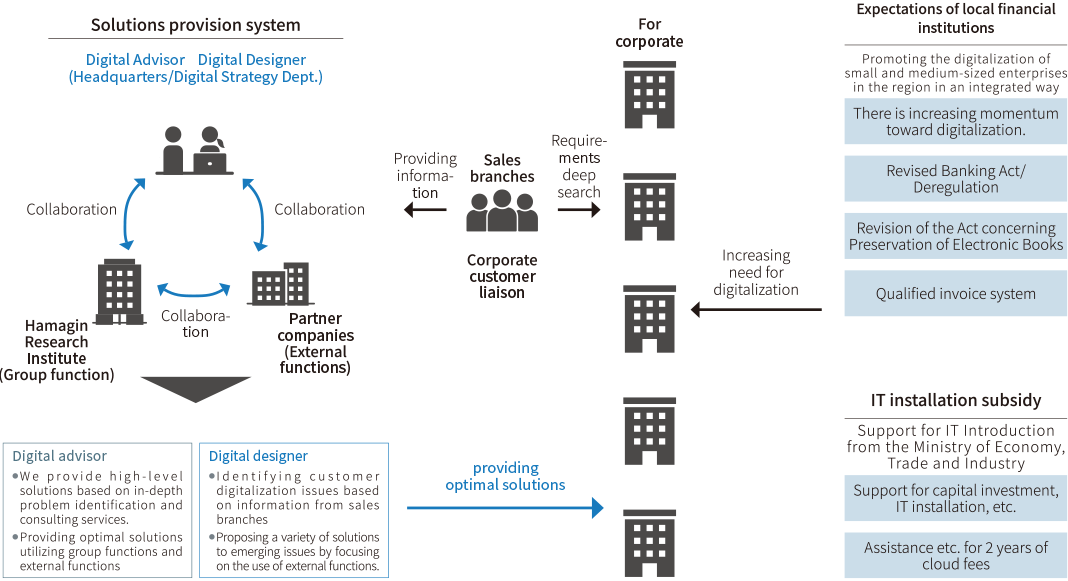

The Bank of Yokohama is supporting the improvement of customer operation efficiency and productivity through digital means, and strengthening its support for digitalization, including compliance with legal systems.

We understand our customers’ digitalization issues and propose and provide optimal solutions in collaboration with about 60 digital companies, including information sharing with head office, in group function collaboration, information processing services, and cloud-based labor and human resource systems.

In addition to providing business matching services as well as consultation services via the Hamagin Research Institute, which leverages the group functions to tackle multi-faceted challenges related to DX, the Bank itself offers a “deployment support service” for customers deploying cloud-based systems as part of its focus on helping them resolve management issues.

Digital transformation of internal banking operations

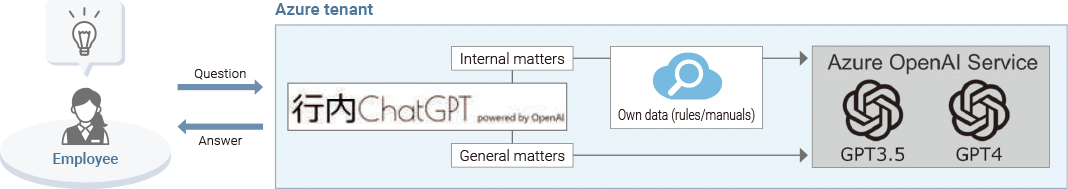

Use of generative AI “Internal ChatGPT” in operations

In November 2023, the Bank of Yokohama and the Higashi-Nippon Bank launched Internal ChatGPT, a GenAI-driven information analytics platform for the exclusive use of employees.

Internal ChatGPT augments the usual ChatGPT functionality by allowing internal information such as the various rules and manuals of the two banks to be referenced. It makes tasks performed by employees, such as document preparation, more efficient*, allowing them to concentrate on more demanding or new tasks.

Looking ahead, we will be enhancing the convenience and expanding the functions of Internal ChatGPT by, for example, adding internet search and file uploads, and will be striving to improve operational efficiency and productivity by integrating GenAI technology into existing operations (systems).

- *It is said that tasks such as general document preparation take 37% less time when ChatGPT is used.

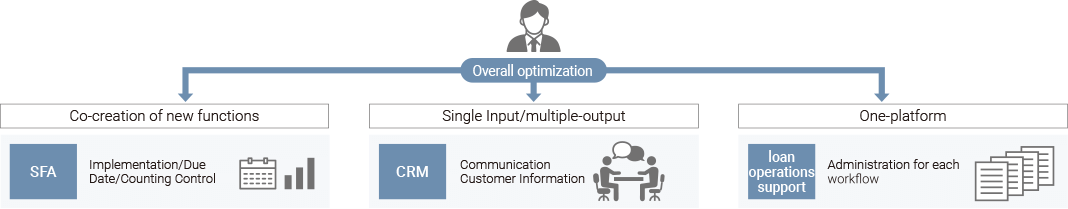

Introduction of the Sales Loan Support System

In January 2024, the Bank of Yokohama and the Higashi-Nippon Bank introduced the Sales Loan Support System, a next-generation SFA/CRM/loan screening system that enabled them to reform their external liaison operations. This system will be used jointly by the five MEJAR banks.

With the introduction of this system, we expect to achieve efficiency gains in many operations. By allocating the time thus saved to liaison activities, we will further refine our efforts to strengthen relationships with customers.

Upgrading IT infrastructure

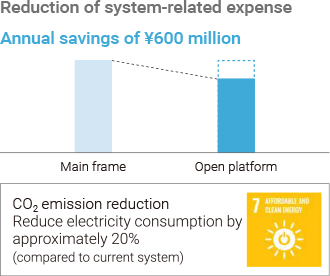

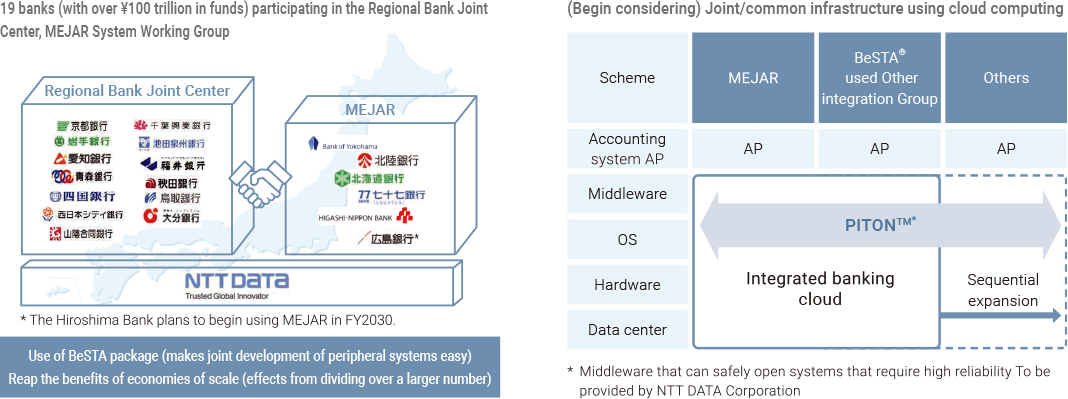

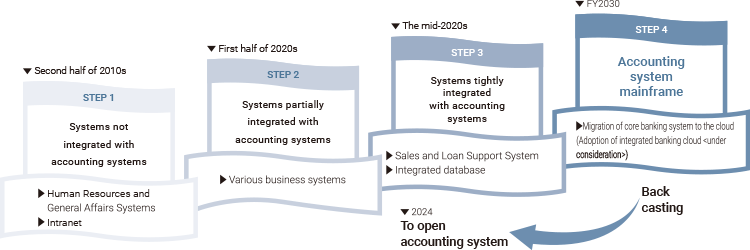

Modernization of accounting systems (shift to open systems and cloud computing)

The Bank of Yokohama and the Higashi-Nippon Bank switched from their current mainframe-based accounting systems to an open platform in January 2024. This initiative is the first in the industry for a jointly used accounting system. The total annual cost reduction for the two banks is expected to be ¥600 million and this will also reduce CO2 emissions.

Furthermore, we have begun exploring the possibility of using, from around FY2030, the “integrated banking cloud”, which is being constructed by NTT DATA and will be Japan’s first open and shared cloud banking system, as the foundation of our next core banking system. This initiative is part of the remit of the Regional Bank Joint Center/MEJAR System-Working Group (CMS-WG), which was established in November 2021.

Cloud computing for the entire system

In anticipation of the future shift of our accounting systems to cloud computing, we are sequentially shifting to cloud computing starting with systems that are farther away from accounting systems.

As of March 31, 2024, 40% of our major systems have been moved to the cloud.

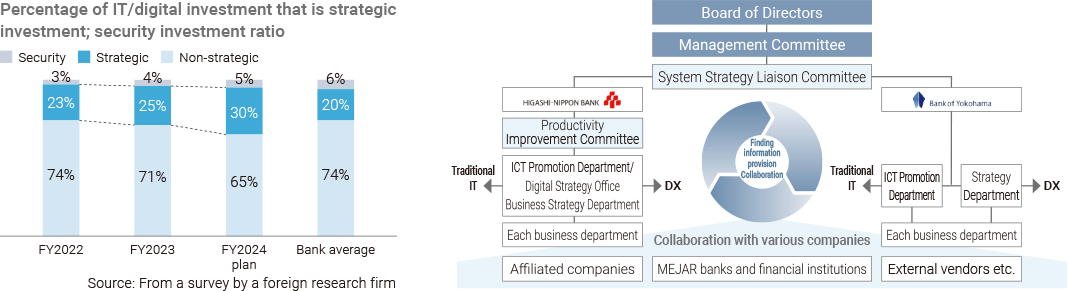

Structure for Realization of Digital Strategy

Strategic investment control and organization design

To achieve our digital strategy and to deal with increasingly sophisticated cybersecurity risks, we will allocate management resources to strategic investments(*1)and security investments(*2)in a focused manner. As of March 31, 2024, we had allocated 25% to strategic investments and 4% to security investments, and will continue to focus on these allocations.

In addition to investing heavily in strategic projects for transformation and growth, we will also invest in non-strategic projects to maintain minimum required levels of functionality. To strike a good balance between the two, we will practice investment control through such forums as meetings of the System Strategy Liaison Committee, which are hosted by us. We will also be actively pursuing cost-sharing through the expansion of alliances.

The Higashi-Nippon Bank has newly established a Digital Strategy Office in its Business Strategy Department to strengthen planning and promotion of non-face-to-face transactions utilizing digital technology.

- (*1)Investments related to IT and digital are classified into three areas: transformation, growth, and operations. Investments classified as transformation or growth are defined as strategic investments.

- (*2)Defined as investments in measures related to cybersecurity.

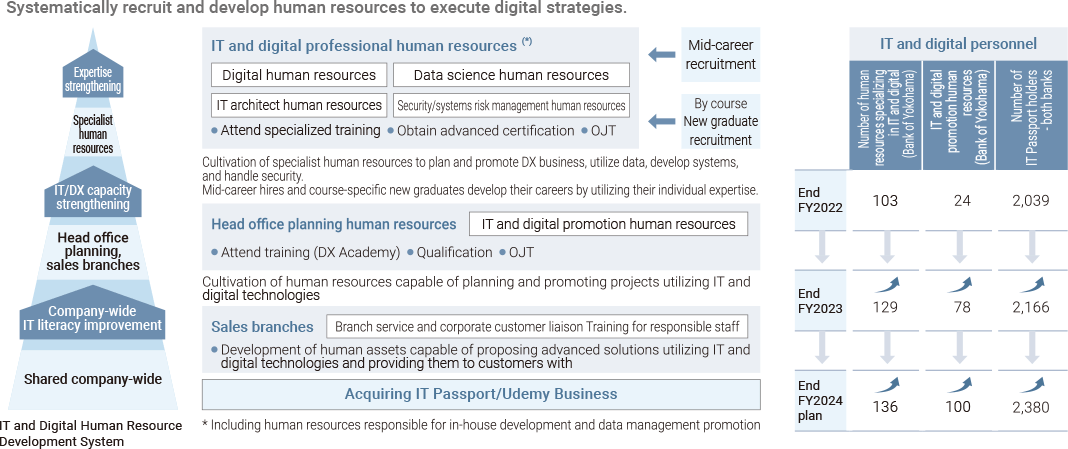

Human Resources

In order to improve IT literacy at the Bank of Yokohama and to strengthen specialist human resources, we define human resource images and expected roles for each training system and promote planned recruitment and training. In October 2022, we launched DX Academy, a digital talent development program to foster IT and digital promotion personnel, and as of March 31, 2024, 78 people had completed the program. Furthermore, to improve the DX skills of all bank employees, in August 2023 we began offering “Udemy Business”, which allows individuals to study content that matches their level in a timely fashion. In this way, we are encouraging personnel to acquire DX skills that they can put to use directly in their work. As a result of this initiative, our IT and digital specialist personnel numbered 129 people as of March 31, 2024.

The Bank of Yokohama and Higashi-Nippon Bank will continue to further develop human resources specializing in IT and digital.