Solving the Problems of an Aging Society with a Declining Birthrate

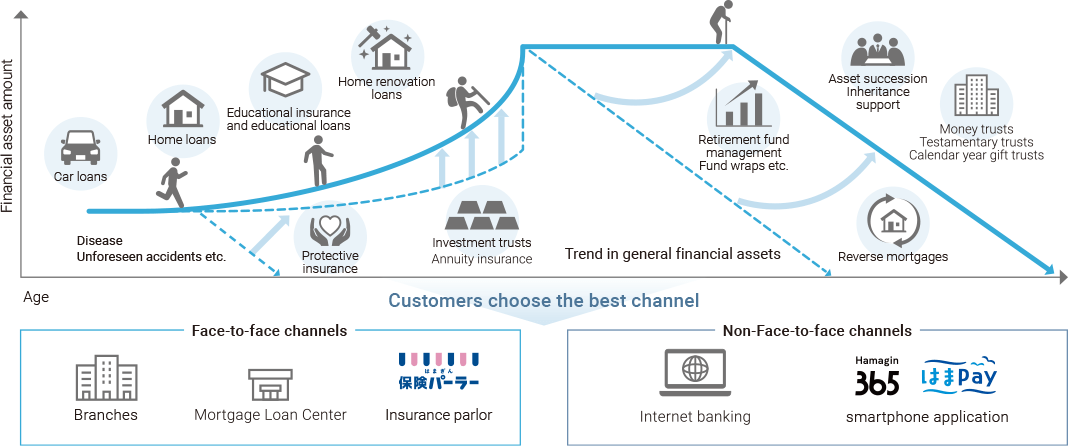

As a lifelong partner, we support our customers’ affluent lifestyles in the age of centenarians by providing optimal solutions for each stage of their lives.

Medium-Term Management Plan Strategy

Providing solutions to match the life stage

With a broad menu of financial products such as banking, securities, insurance, and trusts, we provide optimal solutions for the customer’s life stage. We will also work to expand face-to-face and non-face-to-face channels, including expanding insurance parlors and developing smartphone apps.

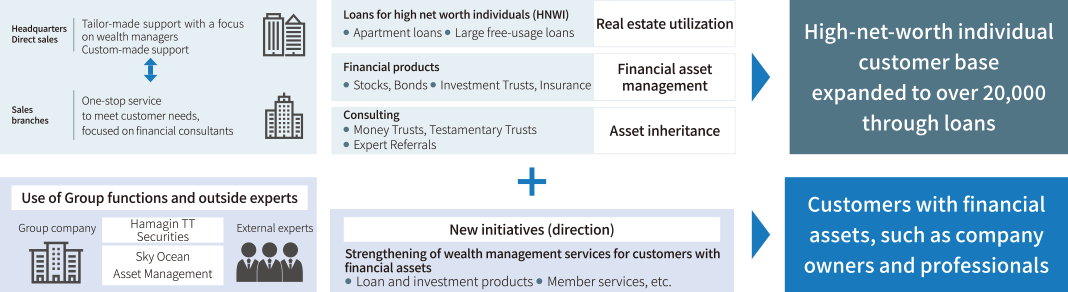

Providing tailor-made, one-stop solutions

We provide tailor-made, one-stop solutions to affluent customers. These have expanded through loan transactions, by utilizing direct sales at head office, group functions, and outside experts.

We also work to provide comprehensive solutions to customers with financial assets by strengthening our wealth management services.

Provide solutions for high net worth customers

In the previous Medium-term Management Plan for FY2022 to FY2024, we worked to strengthen our ability to provide solutions to meet the needs of “real estate utilization,” “financial asset management,” and “asset succession,” thereby expanding our high net worth customer base.

In the current Medium-term Management Plan for FY2022 to FY2024, we will improve profitability by strengthening our ability to provide tailor-made, one-stop solutions to this customer base.

Initiatives in the Current Medium-term Management Plan for FY2022 to FY2024

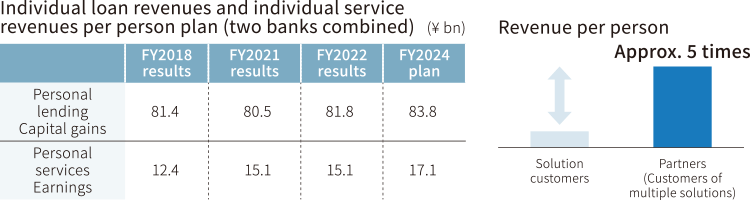

In the current Medium-term Management Plan for FY2022 to FY2024, we have newly defined those customers who select multiple solutions such as asset-based loans, financial products, and consulting as “partners”.

The profitability of each partner is high, and we aim to improve our profitability through initiatives that customers can choose.

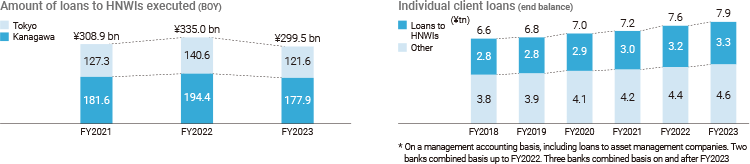

Loans to HNWIs (real estate utilization)

By allocating resources in line with market characteristics and expanding the workforce through human resource development, we have strengthened lending to high-net-worth individuals, primarily those who own real estate, and our personal loan balance has been steadily increasing.

Financial products (financial asset management)

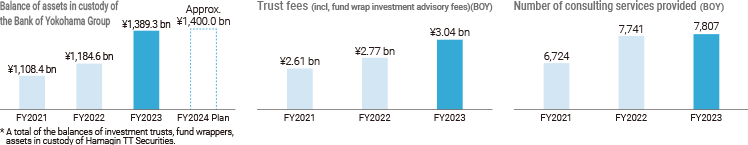

By expanding the product lineup and promoting portfolio proposals based on a goalbased approach, the transition to stock business has steadily progressed, and trust fees, including fund wrap investment advisory fees, amounted to ¥3.04 billion in FY2023.

Consulting (asset succession)

The number of consulting cases reached 7,807 in FY2023 as a result of our efforts to provide tailor-made, one-stop solutions through direct sales by head office, group functions, and the use of outside experts.

Providing solutions for asset building customers

We are working to enhance support for living in the age of centenarians, including support for asset building in accordance with life plans and assistance in managing financial assets in retirement. As a lifelong partner, we will stay close to our customers and help them lead prosperous lives by providing them with financial products and services that best suit their life stages.

Strengthening Bank of Yokohama fund wrap function

In April 2021, the Bank of Yokohama began offering the “Bank of Yokohama Fund Wrap” as a product that can provide gradual asset growth in line with economic growth and preparation for future life events in the age of centenarians. By regularly confirming our clients’ intentions and reflecting them in our investment proposals, we are able to manage assets in accordance with each client’s needs through fund wraps.

Expansion of trust functions

In October 2019, the Bank of Yokohama began handling the Hamagin Okane Trust, a money trust based on a testamentary substitute function to meet the needs of customers for the management and succession of their financial assets. The cumulative number of such contracts signed now exceeds 6,000.

Expansion of Hamagin Insurance Parlors

The Bank of Yokohama has established the “Hamagin Insurance Parlor”, a dedicated insurance consultation service to meet the insurance needs of each stage of life. Our professional staff, who are “insurance professionals” with a thorough knowledge of the characteristics of insurance products, will propose the best insurance plan for you, carefully checking your life plan, your needs, the contents of your existing insurance coverage, and whether or not you need to review it. In order to meet growing insurance needs, we have been expanding the number of branches, and now have a total of five branches in Kanagawa Prefecture.

TOPIC Article Portal site “At Your Side To Help with Your Money and Your Life, Hamacierge” launched.

The Bank of Yokohama will launch an article portal site “At Your Side To Help with Your Money and Your Life, Hamacierge” in September 2022 to help customers solve their money and life troubles. “Hamacierge”(*) has been launched on the Bank of Yokohama website, and we are making efforts to strengthen content marketing. This website features original articles written by financial planners and other experts for each life event such as marriage, child-rearing, nursing care, and retirement. In addition, the Bank of Yokohama categorizes accumulated data on customer age, assets, transaction details, and other attributes to create marketing scenarios. We match the behavioral data of customers using the Bank of Yokohama website and apps to the relevant scenarios, and distribute the most appropriate articles via e-mail and other means.

- (*)A marketing strategy to create content of interest and concern to customers, and through this information, build relationships with customers to draw attention to the company's products and services. “Hamacierge” is a portmanteau of Yokohama and concierge.

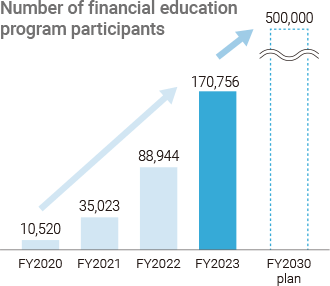

Initiatives for Financial Education

We see financial education as a key responsibility of our Group as we strive to contribute to the sustainable growth and further development of the region and the healthy upbringing of the youth who will lead the next generation. Our banks offer a range of original, branded financial education programs for a wide audience in the community, from children to adults. These include “Hamagin Money Classroom”, “Higashi-Nippon Bank Money Classroom”, and “Kanagin Finance Classroom”.

Website for supporting digitalization

We focus on offering educational opportunities, videos, and teaching materials online, to support the growing digitalization of school education and benefit many people, including households. The Bank of Yokohama’s “Hamagin Money Class Website” received the “Minister of State for Special Missions Award”, the top prize recognizing outstanding teaching materials, at the “Consumer Education Materials Awards 2023” run by the National Institute on Consumer Education. The Bank of Yokohama also offers an online work experience program developed with TOKYO SHOSEKI CO., LTD. In addition, the Higashi-Nippon Bank shares its “Higashi-Nippon Bank Money Classroom Website”.

TOPIC External evaluation of the website

We have worked on beefing up the content of our “Hamagin Money Classroom Website” and it was awarded the “Minister of State for Special Missions Award” as the most outstanding educational material in the “Consumer Education Material Awards 2023” sponsored by the National Institute on Consumer Education (a public interest incorporated foundation)(*). This award system recognizes educational materials created by governments, business and industry associations, consumer groups, and NPOs across Japan by March 2022 that can be used effectively in schools. In addition, the Minister of State for Special Missions (in charge of regional revitalization) of the Cabinet Office, Cabinet Secretariat, presented an award to the company as an “example of distinctive efforts by financial institutions and others contributing to regional revitalization in 2022”.

- (*)The National Institute on Consumer Education was established to contribute to the enhancement and development of consumer education in schools, and is a specialized organization that conducts survey research and prepares teaching materials on consumer education for young people.

The Concept of Financial Education

Financial education is not only the study of knowledge about money, but also the nurturing of the ability to contribute to a richer life and society by means of money. The Group has positioned “the value of money”, “how to use money”, “earning money” and “money management” as “basic money education”, and has built a program in which students learn about these topics and then learn about financial literacy, including asset building and financial struggles.

Fostering future leaders in financial education

The Bank of Yokohama works to train teachers and university students in education departments by offering classes on the “outlines and importance of financial education” as well as classes using its original “basic money education” method. In this way, it aims to foster future leaders in financial education. At a seminar for teachers hosted by the Kanagawa Prefectural Board of Education, home economics teachers from 146 public high schools attended. There were also seminars for teachers at public elementary schools in the Naka and Nishi wards of Yokohama, and lectures at Yokohama National University’s Professional School for Teacher Education and College of Education and others. After the seminars, teachers who attended have been applying financial education in their schools, spreading these efforts throughout the community.

Collaboration with the Tokyo Stock Exchange and local governments

The Bank of Yokohama has started a partnership with Tokyo Stock Exchange, Inc., which leads to the enhancement of financial literacy on asset formation and asset management in a neutral way. In FY2023, the Bank of Yokohama gave five lectures on its basic money education program through the Tokyo Stock Exchange’s video seminar for working adults “Seminar Manebu” as well as an online publication focusing on asset formation, “TSE Manebu” and other programs. In FY2024, we plan to offer courses combining programs from both companies at Yokohama National University and other institutions. We are also working to raise awareness of the new NISA system and iDeCo for working adults, aiming to improve financial literacy in the community.

The Higashi-Nippon Bank joined the Tokyo metropolitan Government’s “Entrepreneurship Education Program for Elementary and Junior High Schools”, providing support for creating an environment, which makes entrepreneurship more accessible and a future career option. THE KANAGAWA BANK takes part in the Yokohama Board of Education’s “Kids Adventure College”. It teaches Yokohama’s elementary school students about the role of banks and related themes like the flow and importance of money.

TOPIC The Bank of Yokohama signed a collaboration agreement with Yokohama National University to cooperate in financial education

In March 2024, the Bank of Yokohama and Yokohama National University signed a collaboration agreement on financial education. In response to the Japanese government’s “Doubling Asset-based Income Plan”, the Japan Financial Literacy and Education Corporation was established in FY2024 as part of joint public-private efforts, which are used strategically to roll out finance and economic education. Against this backdrop, there is a growing need for financial education in schools. Yokohama National University is a key research and training institution for teachers in Kanagawa Prefecture. It has a wide range of educational facilities including a college of education, affiliated primary, junior high, and special needs education schools, and a professional school for teacher education. Since FY2023, the university and its affiliated schools have widely implemented financial education classes. Going forward, the Bank of Yokohama and the university will work together under this agreement to standardize financial education practices in affiliated schools, train future financial educators in the College of Education and Professional School for Teacher Education, and promote, develop, and refine financial education programs.